TL;DR:

- BitMine acquired 35,000 additional ETH in a single day, bringing its total reserves to 4.37 million ETH valued at approximately $9.6 billion.

- BMNR shares fell more than 8% since February 13 and broke below the lower support of a bearish pattern that projects a 50% extension.

- The correlation between BMNR and Ethereum rose from 0.50 to 0.52, turning the asset into a direct proxy for ETH’s performance.

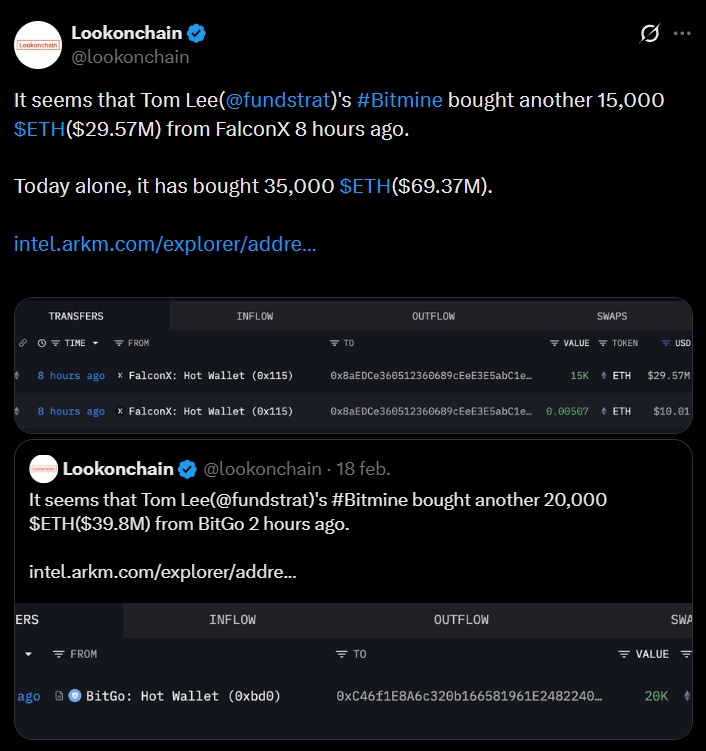

BitMine Immersion Technologies continues to expand its Ethereum treasury. The company founded by analyst Tom Lee acquired 35,000 ETH in two batches during a single trading session, raising its total holdings to 4.37 million ETH.

With combined reserves in cash and crypto assets totaling around $9.6 billion, the firm has become one of the largest corporate ETH treasuries in the market. However, its shares (BMNR) responded negatively: they fell nearly 2% in the last 24 hours and have accumulated a decline of more than 8% since February 13. An aggressive purchase of this scale is typically interpreted as a signal of long-term bullish conviction. In this case, the market did not respond as would be expected.

BitMine (BMNR) Breaks Support: What Is Happening?

The technical analysis of Bitmine’s shares shows that the price broke below the lower boundary of a pattern known as a bear flag, a formation that develops after a sharp decline followed by a weak recovery. When that support gives way, the technical structure suggests that the pullback may extend further. In this case, the pattern’s projection points to a potential decline of more than 50% if selling pressure continues. The key levels to monitor are the support around $15 and, if that floor gives way, the next zones at $12 and $9. A recovery would require reclaiming $21 as a first step and surpassing $29 to confirm a genuine bullish reversal.

Ethereum Sets the Pace for BMNR

Capital flow indicators offer a more nuanced reading. The On-Balance Volume, or OBV, registered higher lows between February 9 and 13 while the price formed lower highs, a signal of silent accumulation by retail investors. The Chaikin Money Flow, for its part, also showed improvement, though it remains below zero, indicating that institutional capital has yet to support a consistent recovery.

The determining factor, however, is external to the company. The correlation between BMNR and Ethereum climbed from 0.50 to 0.52, turning the stock into a high-sensitivity proxy for ETH’s performance. Additionally, the long-short ratio in the ETH futures market fell to extremely low levels, reflecting a predominantly bearish positioning among traders. That pressure on Ethereum translates directly to BitMine, regardless of how much ETH the company accumulates. Unless Ethereum reverses its trend, the expansion of the treasury will hardly be sufficient to sustain the share price.