TL;DR

- Jane Street maintains net long Bitcoin exposure through IBIT, holding 20.3 million shares.

- Despite accumulation, Bitcoin closed Q4 down 24% and $65,000 support remains fragile.

- Long-term holders are sending Bitcoin to Binance with average SOPR at 1.87.

Jane Street maintains a good net long BTC exposure via IBIT (second-largest reported net buyer among visible institutions in Q4 2025), indicating structural accumulation during dips. Observed intraday behavior is predictable market-making noise amplified by extreme leverage in crypto — not malicious dumping.

For traders, 10 AM ET pullbacks remain high-probability long entry zones with tight stops, provided macro/on-chain backdrop remains supportive. Conspiracy narratives drive retail engagement, but 13F filings show clear net institutional bullish positioning.

Jane Street added 7.1 million shares of BlackRock’s iShares Bitcoin Trust (IBIT) worth $276 million in Q4 2025, bringing total holdings to 20,315,780 shares valued at $790 million, according to an SEC filing. The trading giant ranked as the second-largest IBIT buyer during the quarter. Despite the accumulation scale, Bitcoin closed Q4 2025 down 24%, and the $65,000 support level remains fragile months after the Q4 2025 crash.

BlackRock just deposited another 1,701 $BTC($115.2M) and 22,661 $ETH($44.5M) to Coinbase Prime.https://t.co/qmuDIrP9my pic.twitter.com/AxoghUGpf8

— Lookonchain (@lookonchain) February 17, 2026

The Q4 2025 crash erased more than $1 trillion from total crypto market capitalization and triggered a record $19 billion in liquidations. The shock continues influencing positioning and investor behavior even months later. Institutional accumulation of Jane Street’s magnitude typically boosts retail sentiment, yet some traders argue the firm’s activity as a market maker may be contributing to price suppression by capping downside moves while preventing sustained rallies.

There have been persistent whispers in crypto circles about certain institutional trading desks running a very specific/shady playbook…

(Jane Street included.)

ICYMI: Jane Street just ranked as one of the top net buyers of BlackRock's Bitcoin ETF ($IBIT) in Q4 2025.

Their… https://t.co/1nB2jcf7ub pic.twitter.com/LOnxy0AEKn

— Milk Road (@MilkRoad) February 17, 2026

From a technical perspective, the buying did not translate into bullish price action. Bitcoin formed five consecutive lower lows on the weekly timeframe with no clear consolidation developing around the $65,000 zone. Treating the level as a breakout launchpad appears premature given current bid activity does not signal convincing accumulation outside Jane Street’s institutional positioning.

Long-Term Holder Distribution and Elevated SOPR Point to Conviction Erosion

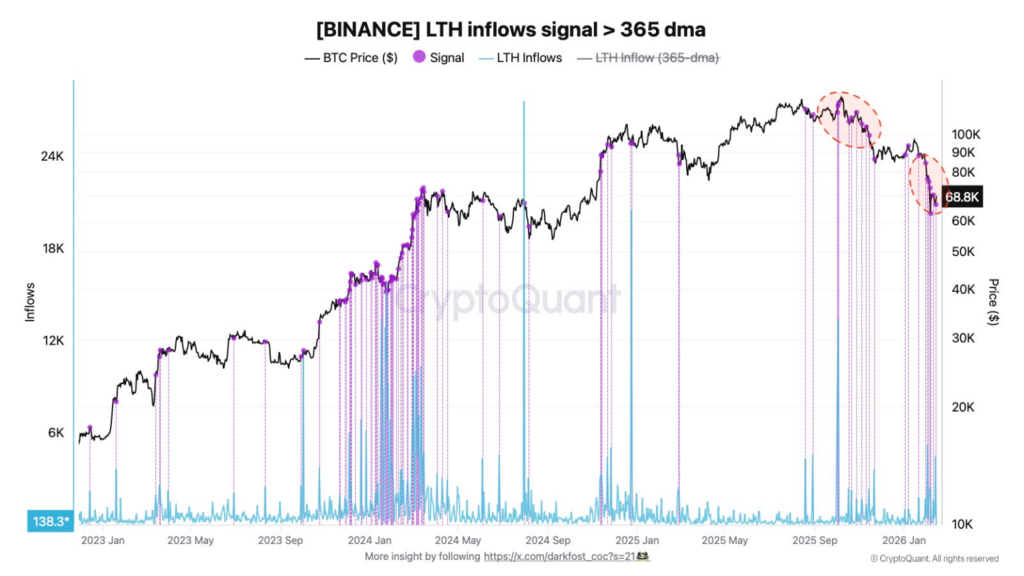

On-chain data shows rising long-term holder (LTH) inflows into Binance, while the average LTH SOPR remains elevated at 1.87. The metric signals long-term holders are increasingly realizing losses on their Bitcoin positions rather than maintaining conviction for future gains.

The data highlights waning conviction among LTHs as realized losses start outweighing the incentive to hold for recovery. The imbalance between LTH distribution and institutional accumulation creates a fragile range where neither buyers nor sellers can establish dominance. IBIT itself corrected 23% so far in 2026, adding pressure to an already strained structure.

The massive accumulation via IBIT suggests Jane Street remains comfortable increasing its beta to Bitcoin rather than exiting exposure. The firm’s positioning points toward systematic accumulation on dips rather than distribution campaigns targeting retail liquidations.

For retail participants or holders with medium-low conviction, the pattern is brutal and seems designed to induce panic. For an OG or institutional desk, it is simply predictable market noise in the maturation cycles of a young asset class. Massive accumulation via IBIT suggests that, overall, the firm is comfortable increasing its beta to Bitcoin—not the opposite.