TL;DR

- Bitcoin drops to $67,500 after a stronger-than-expected U.S. jobs report.

- March rate cut probability collapses from 27% to 8% in one month.

- Gold climbs 1.3% as appetite for buying Bitcoin fades.

Bitcoin fell to around $67,500 on Wednesday, down 2% over 24 hours, after a stronger-than-expected U.S. jobs report reduced the likelihood the Federal Reserve would cut interest rates in March. Altcoins registered steeper losses, with Ethereum dropping 3% to $1,950 and Solana sliding 3.4% to $80 over the same period.

The U.S. Department of Labor reported employers added 130,000 jobs in January, nearly double economists’ expectations of 70,000 jobs, according to Trading Economics. The unemployment rate ticked down to 4.3%, slightly below the anticipated 4.4%. The data signals labor market strength, which reduces pressure on the Fed to stimulate the economy through lower borrowing costs.

Last week, Bitcoin plunged as low as $62,800 before recovering partially to $71,500 on Sunday. The drop marked Bitcoin’s lowest price point in 14 months. The rebound proved short-lived once the employment numbers landed.

After closing 2024 with three consecutive rate cuts, Fed Chair Jerome Powell signaled earlier this month the central bank would maintain a data-dependent approach in considering future adjustments to its benchmark rate, currently set at a target range of 3.50% to 3.75%. The strong jobs report gives the Fed little reason to move rates lower in the near term.

Trader Expectations Collapse as Rate Cut Probability Drops From 27% to 8% in One Month

On Wednesday, traders placed just an 8% chance the Fed would cut interest rates by a quarter percentage point in March, according to CME FedWatch. The figure marked a sharp decline from 20% the day before and 27% a month earlier. Most traders no longer expect a March cut at all.

Jasper De Maere, a desk strategist and OTC trader at crypto market maker Wintermute, noted bond markets signal expectations remain relatively unchanged despite the shift in Fed rate probabilities. The discrepancy suggests investors may be growing more sensitive toward company valuations, particularly around AI and related businesses, rather than reacting purely to monetary policy shifts.

Lower interest rates typically benefit risk assets because investors face lower payouts on cash and other safe holdings, pushing them to seek higher returns elsewhere. Cryptocurrencies, however, have struggled in recent months even as major stock indexes continue hitting record highs. The S&P 500 and tech-heavy Nasdaq initially ticked up after the employment data release but later retreated alongside Bitcoin.

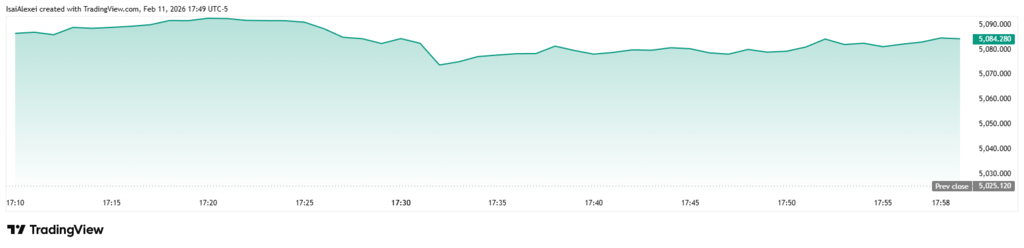

Meanwhile, gold climbed 1.3% to around $5,100 per ounce, according to Yahoo Finance. The divergence underscores Bitcoin’s current positioning relative to other assets perceived as stores of value or hedges against uncertainty.

Chris Beauchamp, chief market analyst at trading platform IG, wrote there appears to be no appetite for dip-buying in the asset class at present. In a world filled with AI developments and where gold continues to shine, Bitcoin’s appeal has firmly waned for now, he noted.