TL;DR

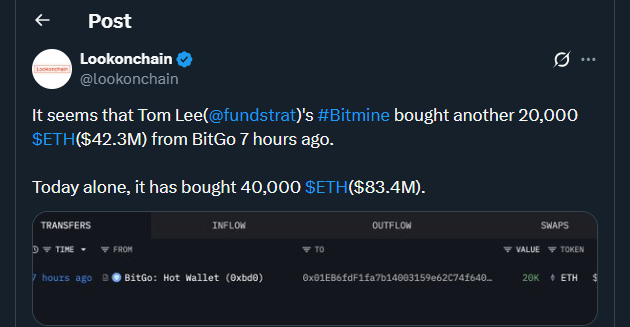

- Bitmine acquired 40,000 ETH in two transactions worth about $83 million, one of the largest private buys this quarter.

- The operation appeared while Ethereum traded near $2,020 and market volumes stayed weak, suggesting long-term accumulation instead of speculation.

- Analysts believe the move reflects institutional confidence in staking demand and network growth during the coming year.

Ethereum captured fresh attention after a large buyer stepped in during one of the quietest trading periods of the year. The accumulation arrived without a price rebound and with limited retail activity, a combination that often signals positioning ahead of deeper market changes rather than a short-term trade.

What The Blockchain Data Revealed

Public records detailed a first movement of 20,000 ETH from FalconX to wallets linked with Bitmine, followed hours later by another 20,000 ETH from BitGo. The assets ended in addresses that had shown minimal activity before, a structure normally associated with strategic holdings rather than trading inventory. When brokers execute short-term orders they usually divide coins across venues, yet this flow remained concentrated.

During the purchases Ethereum traded close to $2,016 and barely changed through the session. The asset had lost around 10% in the last seven days and nearly 35% over the past month, levels that often draw interest from funds focused on value. Dealers in several regions mentioned rising inquiries for staking positions instead of leveraged futures, reinforcing the conservative tone.

Bitmine manages capital for private clients and has emphasized yield opportunities since withdrawals became easier after the Shanghai update. The company rarely comments on individual operations, leaving the market to read signals directly from the chain.

Why The Market Is Paying Attention

Transactions of this size do not force an immediate advance, yet they can reshape available supply. Coins moved to custodial wallets with no record of quick resale tend to reduce pressure on order books. Trading desks in Asia observed that funding rates stayed neutral, a calmer reaction than episodes driven by retail enthusiasm.

Ethereum developers continue work on scaling improvements and client diversity, factors that usually guide institutional allocation. Staking yields near four percent provide a baseline return while broader macro conditions remain uncertain. Several portfolio managers argue that these fundamentals offer a clearer compass than daily volatility.

The event reminded observers that professional capital remains active in Ethereum even during quiet markets. Additional buyers following a similar approach could encourage steadier price action and renewed focus on network usage and fee generation. For now, Bitmine’s choice stands as a visible pro-crypto signal that long-duration investors are willing to build positions before sentiment turns.