TL;DR

- Net ETF flows mask steady buying through financial advisor channels, despite hedge fund outflows.

- Gold crossing $5,000 per ounce creates unexpected comparative pressure on digital assets.

- This drawdown is shallower than in past cycles (~50% vs 77-85%), partly due to long-term ETF holders.

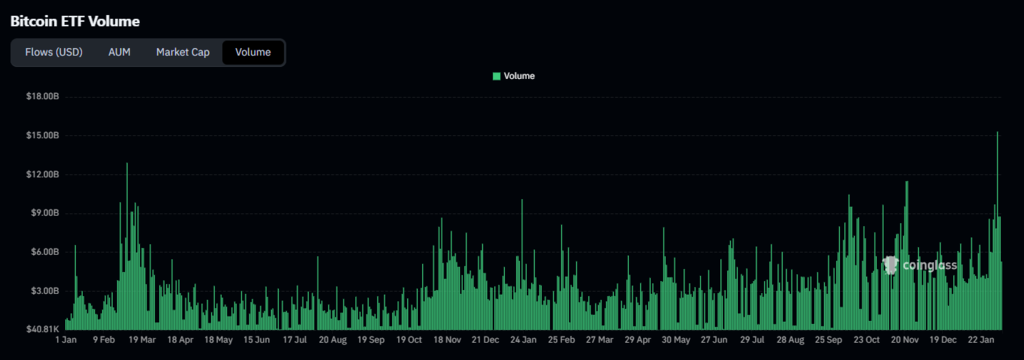

When Bitcoin drops more than 45% from its October 2025 peak, most people assume the wave of selling comes from ETF investors rushing for the exits. The actual data tells a different story.

Net outflows from spot Bitcoin ETFs total roughly $7 billion — a relatively contained number against the $130 billion the sector still holds in assets under management. The bulk of the decline comes from falling prices, not from mass redemptions. In other words, ETF holders are not the ones dragging the market down.

The real sellers are long-term crypto holders — people who built positions over the past 15 years and now choose to trim exposure. On the other side, financial advisor channels are buying the dip. Bitwise CIO Matt Hougan made the distinction clear during a recent CNBC interview: the same ETF product holds two completely different types of investors. One trades with a horizon of weeks or months; the other allocates with a four-to-five-year window in mind.

Hedge funds and short-term traders generate the visible outflows, yet those outflows mask the buying happening through advisory channels. Net flow figures offer only a partial reading of what the market actually does, and the distortion makes outside analysis harder than it looks.

Approximately 40% of spot Bitcoin ETF holders need a 50% price recovery just to break even. Investors who bought near the top carry real psychological pressure, and at current prices, patience runs thin.

Gold Crosses $5,000 an Ounce and Tightens the Squeeze on Crypto

While Bitcoin accumulates losses, gold broke through $5,000 per ounce. GraniteShares CEO Will Rhind acknowledged the discomfort plainly: precious metals were not supposed to outshine crypto assets at a moment like this. Yet it happened, and the comparison lands on the crypto investor from an angle few saw coming.

The current downturn also differs from previous cycles in a meaningful way. In past bear markets, Bitcoin retraced between 77% and 85% from its highs. Right now, the drawdown sits at roughly 50–52%. Hougan credits part of the shallower drop to long-term ETF holders who absorb selling pressure without liquidating. Weekly outflows have also pulled back to under $200 million, a level that has historically pointed toward seller exhaustion rather than continued decline.

Meanwhile, all four of Wall Street’s major brokerages — Morgan Stanley, Merrill Lynch, Wells Fargo, and UBS — now allow client exposure to crypto products. Morgan Stanley pushed further: the firm filed to launch its own spot Bitcoin ETF after clearing its roughly 15,000 financial advisors to pitch existing crypto vehicles to clients.

Hougan does not expect a sharp or sudden recovery. Bear markets, in his view, end through exhaustion, not excitement. The full entry of firms like Morgan Stanley, he added, could become part of the fuel that accelerates prices once the cycle finally turns upward.

For now, the floor holds — fragile, contested, but still standing.