TL;DR

- A Bloomberg Intelligence strategist said Bitcoin may return to the $10,000 zone if global risk appetite keeps weakening and equity volatility rises.

- The analyst described the $64,000 area as a pause, not a firm floor, warning that the recent rebound may be temporary.

- Pro-crypto analysts highlighted ETF adoption and payment growth as factors that could reduce the depth of any decline.

Bitcoin started February with sharp swings after falling to $61,000 and later recovering toward $70,000. The movement reopened the discussion about whether the market is experiencing a normal adjustment or a longer reset. Mike McGlone from Bloomberg Intelligence presented a cautious view and argued that the enthusiasm still needs to cool.

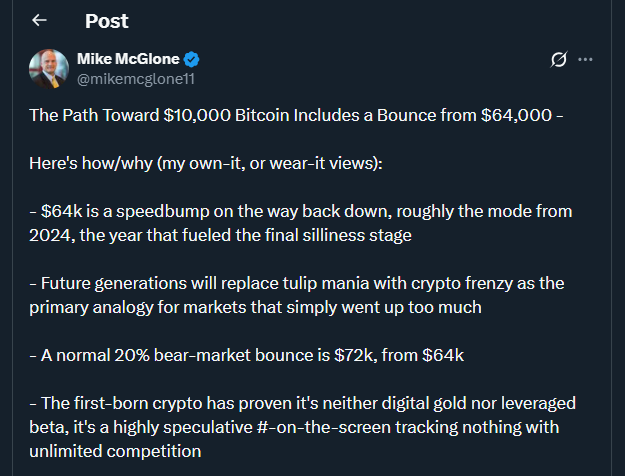

He said the $64,000 region worked as a common price zone last year and should be treated as a reference level rather than solid support. A rebound to $72,000, in his opinion, would equal a traditional 20% bounce seen in bearish phases. The strategist added that Bitcoin continues to behave as a speculative asset influenced by liquidity conditions and not yet as digital gold.

Market participants with a pro-crypto stance responded that the structure today is different from previous cycles. They pointed to spot ETFs in the United States, clearer rules in Asia, and the growth of stablecoins for payments. Those elements, they said, create real demand that did not exist in earlier downturns.

Bitcoin Could Retrace To $10,000 And Market Signals

McGlone connected the crypto outlook with the situation in traditional markets. He expects the calm in the S&P 500 to fade and believes stretched equity valuations could trigger a wider risk reduction. Under that scenario, high-beta assets such as Bitcoin would face pressure. The analyst mentioned that only a sustained move above $90,000 would challenge his negative framework.

Data from the first week of February showed net outflows from major exchange-traded funds, including more than $300 million from a leading product. The flows suggested that short-term investors were taking profits after the rally of late 2025. At the same time, on-chain metrics indicated that long-term holders kept most positions unchanged.

Equity Volatility And Adoption Drivers

Supporters of the asset highlighted that developer activity and cross-border payment use continued to expand. Payment processors in Latin America and Southeast Asia reported higher volumes settled in stablecoins during January. Exchanges also launched new custody services for pension funds and family offices.

Bitcoin traded near $69,600 at press time and remained about 10% lower for the week. Technical analysts said reclaiming $70,000 could open the path to $72,500, while failure to hold that range might invite another test of lower levels.