TL;DR

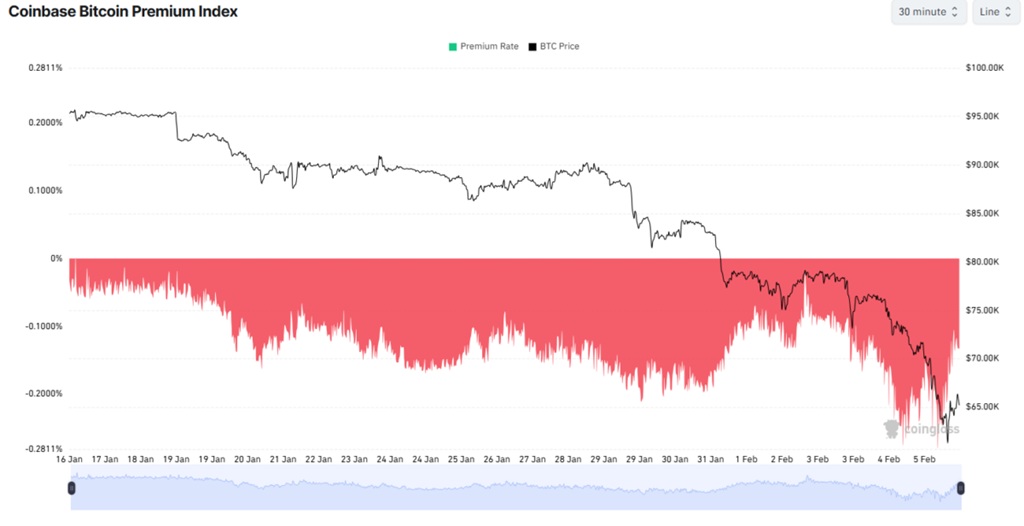

- Bitcoin traded with a negative Coinbase premium of -0.20, the lowest level since January 2025, after falling to the $63,000 area.

- Pressure was concentrated in the U.S. market, where institutional flows through Coinbase Prime Custody accelerated selling and deepened the deterioration of the indicator.

- Trading was dominated by the Asian session. The U.S. and Europe showed weak traction, with an RSI at 21.70 points and the Fear & Greed Index dropping to five points.

Bitcoin posted a negative premium on Coinbase, the lowest since January 2025, amid capital outflows from the United States and a sharp price decline. The gap between BTC’s price on the exchange and on other platforms widened during the latest correction, when its value fell to the $63,000 area. The Coinbase premium indicator slipped into negative territory at -0.20 and showed price differences of up to $150 compared with other international platforms.

Institutional Flows Exit Through Coinbase

The weakness in the indicator coincided with a wave of concurrent selling from the U.S. market. Most of Bitcoin’s institutional flow comes from U.S.-based entities, which primarily operate through Coinbase Prime Custody. When the premium remains negative for extended periods, historical market behavior shows distribution processes concentrated in that segment. During the latest downturn, the deterioration of the indicator intensified and reached its deepest point on February 5.

At the same time, Bitcoin’s trading activity became concentrated in the Asian session. The U.S. and European sessions showed limited returns and lower traction. In practice, gains generated during the Asian open tended to fade over the course of the day. Bitcoin’s price reflected that dynamic through a lack of follow-through during Western trading hours.

The drop in BTC’s price from the $90,000 area to the $60,000 range was accompanied by a massive liquidation of long positions. Those positions had accumulated on expectations of a recovery and were wiped out during the decline. Liquidity data shows that concentrations of open long positions still remain down to the $60,000 level, keeping the market under a persistent pressure structure.

The Fear & Greed Index Hit Historical Lows

Technical indicators point to extreme conditions. The relative strength index fell to 21.70 points, while the Fear & Greed Index dropped to five points, near historical lows. Those levels were driven by forced selling that affected both retail wallets and large holders.

In addition, regional price behavior ruled out exchange-specific events in Asia. The positive premium on Binance and elevated activity in that region contrasted with the persistent weakness of the U.S. market. Bitcoin lost momentum across some of its most active markets and became dependent on a single daily liquidity window, without the ability to sustain gains throughout the rest of the session