TL;DR

- Digital asset treasury stocks fall below the value of their underlying crypto holdings.

- The premium over the asset collapses as companies fail to generate extra yield.

- Firms like Empery and ETHZilla are forced to sell crypto to cover obligations.

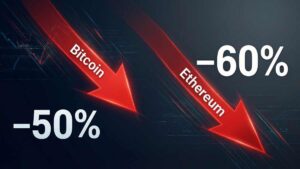

Buying and holding cryptocurrencies used to represent a surefire path for some companies to achieve quick and large gains. Now with Bitcoin plunging more than 45% from its peak, shares of such firms are declining alongside crypto assets. While digital asset treasuries once traded at a premium to their crypto holdings, as token prices retreat, many DAT stocks now trade at a discount.

Bitcoin traded below $70,000 on Thursday, reaching its lowest price since October 2024. Ether fell to its lowest price since May 2025. The median return for U.S. and Canadian-listed digital asset treasury companies has fallen 17% so far this year, according to data compiled by Bloomberg. This compares to a median 5% gain in stocks on the S&P 500 Index.

Michael Lebowitz, portfolio manager at RIA Advisors, observed the pattern. He said rolling waves of bubbles have emerged since 2020. Meme stocks, tokens, and SPACs followed one another. Digital asset treasury companies were just one of those speculative bubbles, with the bubble residing in the premium paid above crypto holdings. That premium has now collapsed completely.

The End of the Treasury Premium Era

With mounting pressures, DATs no longer attract investors, according to B. Riley Securities analyst Fedor Shabalin. He explained that a short-term spike of excitement led to investor realization. To justify any premium above underlying crypto assets in stock form, companies need to generate extra yields from somewhere. Bitcoin produces no yield. For DATs with weaker share prices and debt payments coming due, selling crypto to generate income became necessary — something unthinkable before.

Empery Digital Inc., a Bitcoin treasury firm, announced on Monday that it had begun selling Bitcoin to fund share repurchases. The company’s stock traded at a discount to its holdings. In December, ETHZilla Corp., a Peter Thiel-backed Ether treasury company, announced that it sold $74.5 million worth of tokens to pay down debt.

Shares of Strategy Inc., the original DAT, used to command a premium of more than double its underlying Bitcoin holdings. Now the company trades at merely a 9% premium. Founded by Michael Saylor, the company has seen shares fall 26% so far this year.

On Wednesday, Canaccord Genuity cut their price target on the stock by 61%, citing lower Bitcoin prices and smaller premium. Strategy expected to report a multibillion dollar loss on Bitcoin value in fourth-quarter earnings.

While some DATs like Strategy maintain a strong balance sheet to withstand current downturns, others explore alternative options to survive. In 2025, Bitcoin treasury Strive Inc., co-founded by former Republican presidential candidate Vivek Ramaswamy, agreed to acquire rival Semler Scientific Inc. DATs often fund crypto purchases through issuing debt or securities. With crypto prices remaining depressed, smaller firms in the space face default risk if not acquired by larger players.

The sharp drop in price and premium for DATs moved swiftly. Michael Lebowitz expressed no surprise about the downturn. “If you want to own Bitcoin, just own Bitcoin,” he said. Investors have finally started to realize that fact.

The thesis supporting DAT premiums depended on companies generating returns beyond Bitcoin ownership alone. Without yield generation from the asset itself, companies holding large Bitcoin positions merely replicate what individual investors can do independently. The arbitrage opportunity disappeared once institutional enthusiasm faded and crypto prices declined.