TL;DR

- Bitcoin and Ethereum fall ~50% and 60% from 2025 highs to late-2024 lows.

- Massive liquidations and macroeconomic risk-off sentiment are amplifying the current selling pressure.

- Historical 80% average corrections suggest the absolute market bottom may not yet be in.

Bitcoin and Ethereum traverse a turbulent period marked by sharp declines, liquidations, and widespread risk-averse sentiment. At the beginning of February 2026, both assets register significant losses that have captured the attention of investors and analysts throughout the industry.

Bitcoin trades around $63,000 to $64,000, recording declines of 11% to 13% in the last 24 hours and exceeding 20% during the week. Ethereum negotiates in the range of $1,850 to $1,900, also experiencing similar short-term losses. Both cryptocurrencies have reached lows unseen since late 2024 or early 2025.

Declines acquire greater relevance when compared with 2025 highs. Bitcoin retreated approximately 50% from its peaks near $126,000. Ethereum experienced even deeper relative losses, with declines exceeding 60% from its maximum during that same period.

The Reasons Behind Current Market Pressure

Massive liquidations accelerate downward movement. Between $1 billion and $2 billion in cryptocurrency liquidations occurred in recent 24-hour periods, generating a domino effect that amplifies forced selling. Deleveraging accelerates price declines while leveraged traders are forced to close positions.

Broader macroeconomic factors contribute to pressure. Speculation related to Federal Reserve decisions, redemptions from exchange-traded funds, and rotation toward lower-risk assets have generated a general risk-off environment. Core narratives supporting Bitcoin, such as its role as “digital gold,” and the strength of Ethereum’s ecosystem face doubt during this correction.

On-chain and sentiment indicators show extreme fear. The Fear and Greed Index registers single-digit or low double-digit levels, while exchange inflows signal selling pressure. Bitcoin dominance shows signs of weakening in some analyses.

Searching for Market Bottom and Historical Perspectives

Determining the exact bottom proves impossible given cryptocurrency’s characteristic volatility. However, analysts offer several scenarios based on technical and historical trends. For Bitcoin, recent lows around $62,000 to $64,000 represent a potential near-term floor. More pessimistic forecasts suggest ranges of $50,000 to $60,000 as a realistic zone, while extreme bear scenarios project $38,000 to $40,000.

Ethereum shows greater relative weakness. Key support levels around $1,800 to $2,000 were tested, exposing $1,600 to $1,800 or lower. The ETH/BTC ratio reached several-year lows, with bearish indicators pointing downward.

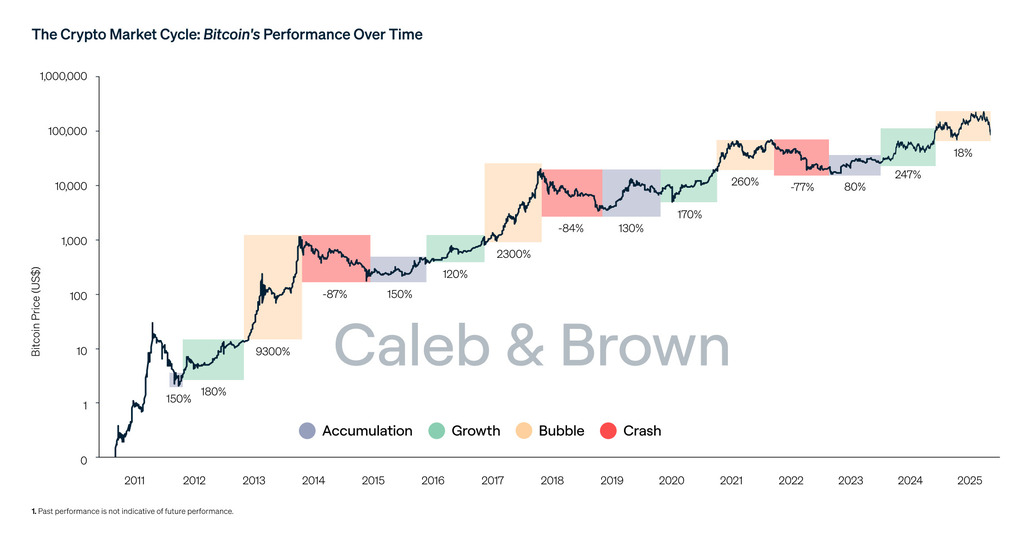

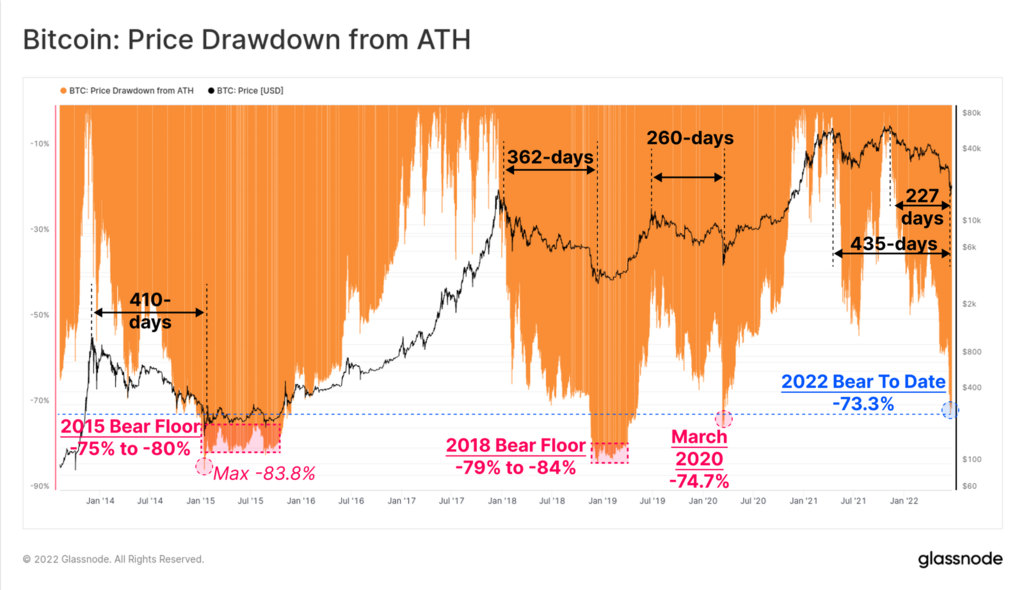

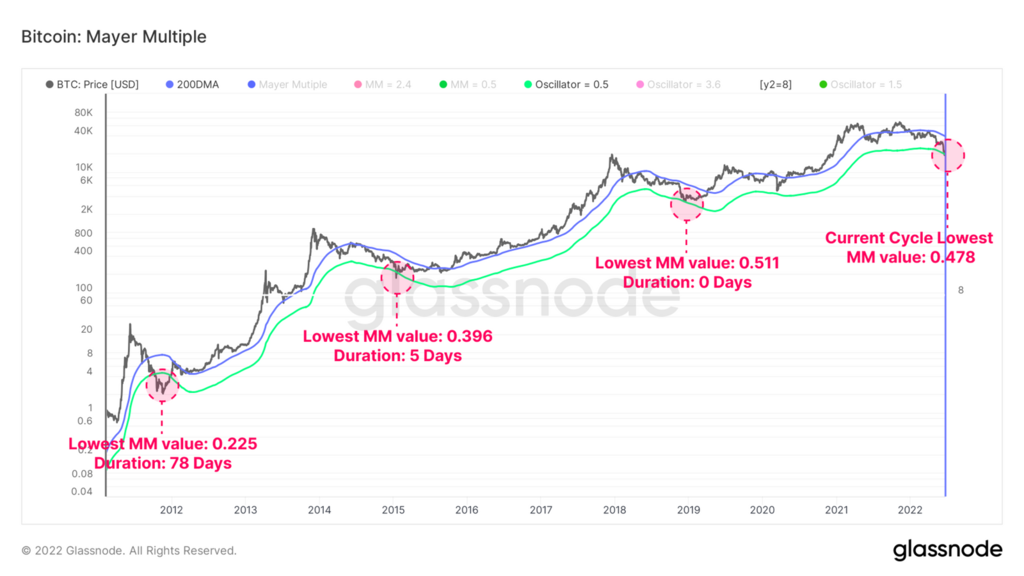

Historical crypto market cycles revealed patterns of deep but cyclical correction. Bitcoin declines have averaged approximately 80% from historical highs, with typical durations of one year for the majority of decline.

The 2011 crash registered declines of 93% to 99%. The 2013–2015 correction produced losses of 85% to 87%. The 2017–2018 crypto winter resulted in declines of 84% to 86%. The 2021–2022 fall recorded declines of 75% to 78%.

Ethereum, launched in 2015, has historically amplified Bitcoin’s pain. During the 2018 bear, ETH suffered declines of 94%. In 2021–2022, it experienced losses of 80% to 82%, frequently 5% to 10% deeper than Bitcoin in percentage terms.

General patterns show that genuine capitulation and seller exhaustion precede accumulation and multi-year recovery. Crypto Economy analysts point out that we likely have not reached the absolute floor, with expectations of more bleeding before true capitulation.

Others identify signs of exhaustion and view current levels as accumulation opportunities for long-term investors. Remember that this does not constitute financial advice, and markets can remain irrational longer than expected.