TL;DR

- Eight European tokenization firms warned that the DLT Pilot Regime limits the development of tokenized capital markets and could cause the EU to lose its advantage to the U.S.

- They proposed removing restrictions on tokenizable assets, increasing the transaction volume cap, and eliminating the six-year limit on licenses.

- The firms cautioned that inaction could lead to liquidity permanently migrating to the U.S.

Eight European tokenization firms warned that the European Union risks losing its early lead in tokenization to the United States if the current regulatory framework is not adjusted.

The companies noted that the DLT Pilot Regime, designed to regulate blockchain-based financial infrastructure, is too restrictive and limits the development of tokenized capital markets.

Excessive and Detrimental Regulations

The group, composed of Securitize, 21X, Seturion from Boerse Stuttgart Group, Central Securities Depository, Lise, OpenBrick, STX, and Axiology, urged European policymakers to accelerate regulatory changes. They proposed removing restrictions on the types of assets that can be tokenized, raising the transaction volume cap from €6–9 billion to €100–150 billion, and eliminating the six-year limitation on licenses.

The firms warned that failure to act could cause liquidity to migrate permanently to U.S. markets and affect the euro’s competitiveness relative to U.S. financial systems. The letter highlights that while Europe debates, the U.S. has advanced with SEC no-action letters and T+0 instant settlement projects, as well as 24/7 trading plans for tokenized securities from Nasdaq and NYSE. CME Group is collaborating with Google on tokenized collateral, with a planned launch in 2026.

Europe Must Act Immediately to Maintain Leadership in Asset Tokenization

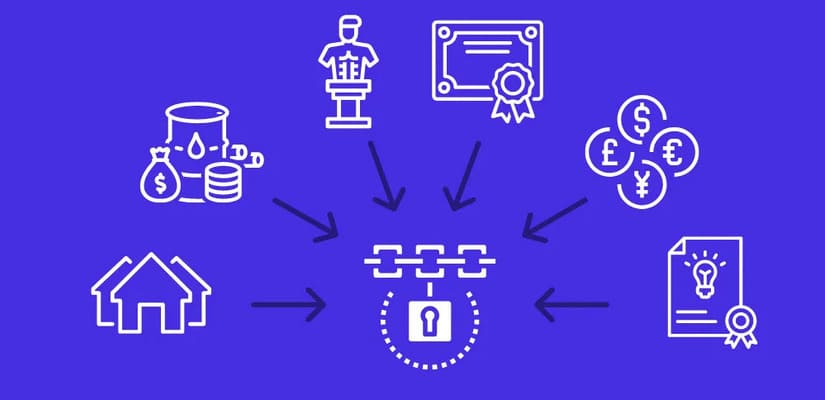

Tokenization allows the issuance of real-world assets such as stocks, bonds, or funds as blockchain-based tokens, increasing settlement speed, transparency, and enabling fractional ownership. Industry reports project that the tokenized asset market could reach multiple trillions of dollars in the coming years.

The group emphasized that Europe must act before 2030, when the Market Integration and Supervision Package (MISP) takes effect, to prevent the region from losing its leadership in tokenized financial infrastructure. The firms indicated that the pilot’s current limits could turn Europe’s advantage into a regulatory obstacle, while the U.S. positions itself to dominate blockchain-based capital markets in the coming years.

The companies urge regulators to immediately amend the framework to allow a more open market, with higher transaction volumes, extended-duration licenses, and removal of restrictions on tokenizable assets, ensuring that European markets remain competitive with the U.S