TL;DR

- A Swissblock analysis shows Network Growth and Liquidity recovering while Bitcoin’s price remains under pressure.

- The current pattern suggests an early accumulation phase, not a broad market exit.

- However, the price could still test levels near $50,000-$52,000 if fear remains elevated.

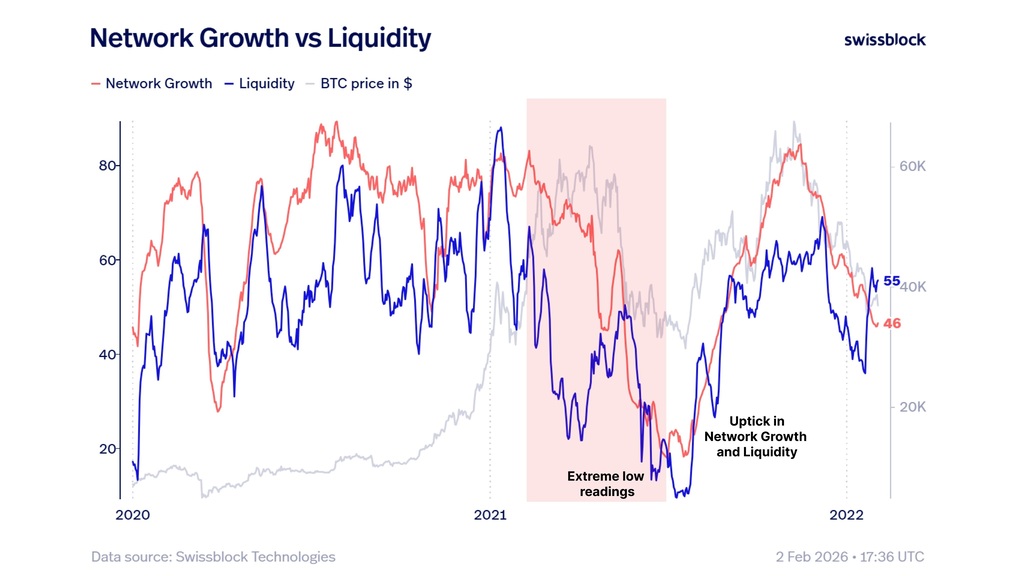

The analysis shared by Swissblock Technologies places Bitcoin under a lens that goes beyond daily price swings. A proprietary chart compares Network Growth, Liquidity, and the BTC price in dollars from 2020 through early 2026. The visual pairs on-chain signals with capital flow data to explain cycle phases that price action alone often masks.

Between 2020 and 2022, the data traces clear cycles. During 2021 and 2022, both network growth and liquidity reached extreme lows, while Bitcoin traded near the $20,000–$30,000 range after the prior peak. Shortly after, both metrics turned upward together and preceded strong price advances. In past cycles, improvements in network use and capital availability appeared before sustained rallies.

Current divergence between fundamentals and BTC price

Recent readings show a different setup. After renewed drawdowns, Network Growth and Liquidity start to recover from fresh lows, while Bitcoin trades near $55,000, reflecting a decline close to 46% from recent highs. The divergence stands out: underlying activity and capital conditions improve, yet price pressure persists in the short term.

Swissblock reads the pattern as a phase where market participants return mainly to sell weak rebounds. Such behavior keeps volatility high and price action uneven, with room for additional tests near $50,000–$52,000 if fear remains elevated. Even so, the data points toward early accumulation rather than broad exit. Network participation expands, and liquidity flows show renewed interest despite falling quotes.

Over a window of weeks or months, a sustained rise in network growth and liquidity could support a late-cycle advance similar to the final leg seen after the 2021 lows. The outcome depends on macro conditions, global capital flows, and the actions of long-term holders. Swissblock avoids any call for instant optimism.

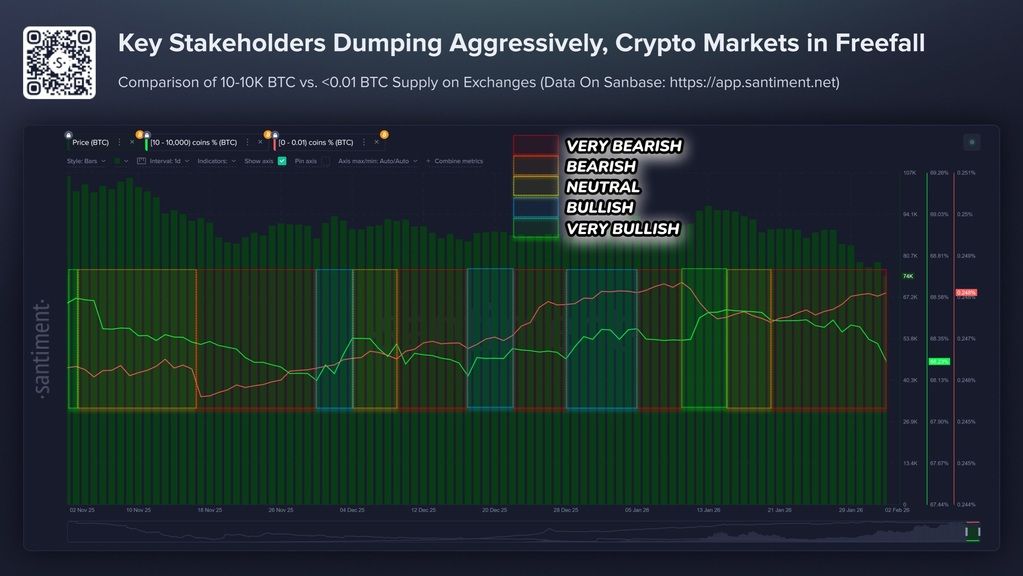

Large Bitcoin Holders Are Selling While Retail Buys, Says Santiment

The recent analysis released by Santiment raised fresh warnings across the Bitcoin market after revealing a clear shift in holder behavior. Shared through the @santimentfeed account, the report compares the share of BTC supply held on exchanges by two opposing groups: wallets holding 10 to 10,000 BTC, which control close to 68% of total supply, and wallets holding less than 0.01 BTC, linked to retail participants. The chart overlays both metrics with BTC price data and shows a sharp deterioration in market conditions since late 2025.

From November through early February, Bitcoin’s price drops from the $74,000 area toward a range between $67,000 and $55,000. During the same period, large holders steadily reduce exposure, while smaller buyers add positions. Santiment labels the current phase as very bearish, a condition that in past cycles aligned with extended declines or delayed capitulation.

Large holder distribution and rising downside pressure

The observed pattern reinforces a long-standing market behavior. Santiment data shows prices often rise when large holders accumulate and retail investors sell under fear. By contrast, declines tend to deepen when large holders distribute supply and retail buyers step in during pullbacks. Earlier in January, the pattern favored accumulation by larger wallets and offered relief signals. The recent reversal marks a complete behavioral shift.

Retail accumulation now unfolds amid ongoing liquidations, elevated volatility, and broad stress across crypto markets. Santiment reads the setup as a phase where stronger hands transfer risk to participants with limited staying power. In previous cycles, similar conditions preceded further downside before a clear base formed.

In the short term, the model points to sustained downward pressure and possible tests near the $50,000–$52,000 zone unless behavior changes quickly. Over a broader horizon, the decisive signal remains a role reversal: large holders returning to accumulation while retail investors cut exposure. Until such a shift appears, on-chain data maintains a cautious stance on the near-term path of Bitcoin’s price.