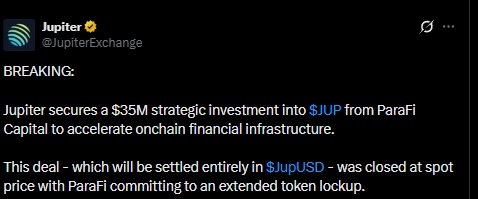

Jupiter Exchange secured a $35 million strategic investment from ParaFi Capital to expand its onchain financial infrastructure. The deal was executed at spot price and will be settled entirely in the JupUSD stablecoin. ParaFi Capital agreed to an extended token lockup period, aligning the investment with the ecosystem’s long-term development.

The funds will be used to grow onchain infrastructure, strengthening Jupiter’s position as a liquidity and trading layer within the Solana ecosystem. The company has moved beyond its initial role as a decentralized exchange aggregator, now including derivatives, stablecoins, and advanced trading tools.

Following the announcement, the Jupiter token trades around $0.1838, up 1%, with a market capitalization near $596 million and a 24-hour trading volume exceeding $60 million.

The deal represents a vote of institutional confidence in the project and prioritizes infrastructure development over short-term growth. The exchange remains among the onchain platforms continuing to attract institutional backing despite high market volatility.

Source: https://x.com/JupiterExchange/status/2018191577143747014

Disclaimer: Crypto Economy Flash News are based on verified public and official sources. Their purpose is to provide fast, factual updates about relevant events in the crypto and blockchain ecosystem.

This information does not constitute financial advice or investment recommendation. Readers are encouraged to verify all details through official project channels before making any related decisions.