TL;DR

- Binance executed the first SAFU fund conversion by purchasing 1,315 BTC for $100.7 million, kicking off a $1,000 million migration plan.

- The fund’s structure includes rebalancing rules that require additional BTC purchases if its value falls below defined thresholds.

- On-chain data showed accumulation signals from large holders and whales.

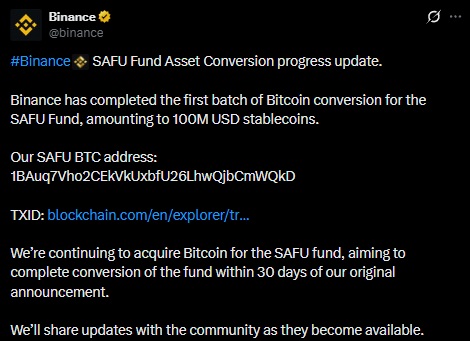

Binance carried out its first Bitcoin purchase under its $1,000 million SAFU fund conversion plan. The operation involved the acquisition of 1,315 BTC valued at approximately $100.7 million, according to on-chain data. The funds came from stablecoins previously allocated to the Secure Asset Fund for Users.

The transaction was recorded at the SAFU fund address, which received the 1,315 BTC in a single transfer. Binance later confirmed that this purchase corresponds to the first tranche of the conversion program announced days earlier. The plan establishes that the fund will be migrated from stablecoins to Bitcoin progressively over a 30-day period. After this initial operation, roughly $900 million remains to be converted.

Binance Will Be Required to Buy More BTC if the Price Keeps Falling

The purchase coincided with strong selling pressure across the market. Bitcoin is currently trading below $78,000, after losing the $80,000 level over the past weekend. Binance operated amid a phase of high volatility and liquidity outflows across spot and derivatives markets.

The SAFU fund structure incorporates automatic rebalancing rules. If the fund’s value falls below a defined threshold as a result of a decline in Bitcoin’s price, Binance must execute additional purchases to restore its target value. This mechanism introduces a recurring source of demand while the conversion is underway and while price pressure persists.

On-chain data also showed that, hours before the purchase, the SAFU fund address executed authorization transactions to add new addresses to its whitelist. This type of activity is typically associated with preparations for future transfers or asset acquisitions.

Whales Buy the Dip

At the same time, accumulation signals emerged from other large holders. Strategy executive chair Michael Saylor posted a message on social media that was interpreted as a reference to a potential new Bitcoin purchase. Separately, fresh data from CryptoQuant indicated that whales continued to accumulate BTC during the latest market correction.

With $900 million still pending conversion, the SAFU fund stands as one of the main sources of structural Bitcoin demand in the short term. Upcoming purchases will be executed according to the announced schedule, as the market continues to move through a period of adjustment and liquidity redistribution