TL;DR

- Talos closed a $45 million Series B extension, bringing the total raised to $150 million and setting a post-money valuation of approximately $1.5 billion.

- The platform provides institutional infrastructure for trading, portfolio management, risk, treasury, and settlement.

- Talos doubled its revenue and client base over the past two years.

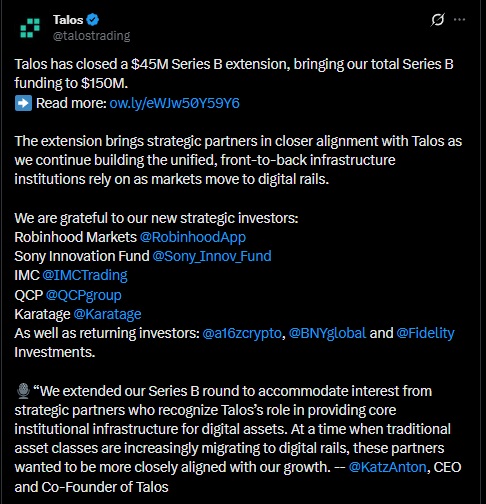

Talos closed a $45 million extension of its Series B round, increasing total funding to $150 million. The transaction set a post-money valuation of approximately $1.5 billion and added new strategic investors to the company’s cap table. These include Robinhood Markets, Sony Innovation Fund, IMC, QCP, and Karatage. Existing investors also participated, including a16z crypto, BNY, and Fidelity Investments.

The company decided to extend the round to bring in strategic partners that already use its infrastructure. Talos provides institutional-grade trading, portfolio management, and data tools for banks, brokers, and asset managers operating in digital assets. The platform covers execution, risk management, treasury, and settlement processes.

Part of the funding was settled using stablecoins. The company confirmed that this mechanism was used to close a portion of the investment through institutional-sized transactions. The capital raised will be allocated to expanding product development and broadening support for additional asset classes.

The plans include integrating traditional assets into digital infrastructure. Talos is developing tools that allow institutions to operate tokenized assets within workflows similar to those currently used for crypto assets.

Why Robinhood and Sony Are Investing in Talos

Robinhood’s participation is tied to its push into onchain infrastructure, tokenized assets, and blockchain-based settlement. Company executives said Talos is used to deepen liquidity and expand trading capabilities within its crypto business. Sony Innovation Fund highlighted Talos’s evolution into a comprehensive solution covering front, middle, and back office functions, with integrated data and analytics.

The round closed following a period of sustained growth. Talos reported that it doubled both revenue and its client base in each of the past two years. Recent milestones include the launch of a request-for-quote platform integrated with BlackRock traders on the Aladdin system.

The company also completed a series of acquisitions to expand its technical and operational capabilities. It acquired Coin Metrics, Cloudwall, Skolem, and D3X Systems, firms focused on data, risk management, DeFi infrastructure, and portfolio engineering