TL;DR

- Hyperliquid cut monthly team token unlocks by nearly 90%, sharply reducing short-term supply pressure on HYPE.

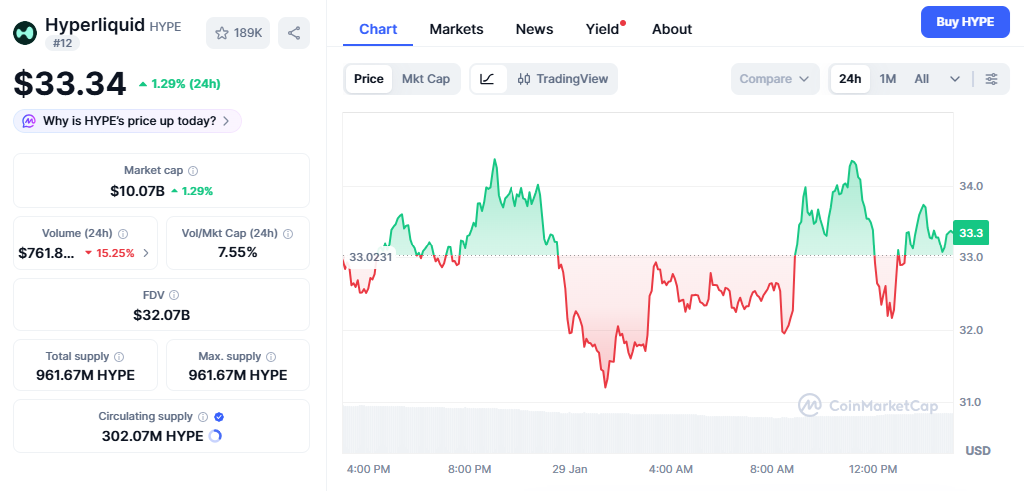

- The token trades at $33.34, up 1.29% in the last 24 hours and more than 55% over the past week, supported by rising volumes and open interest.

- Strong derivatives activity, protocol-funded buybacks, and improving technical signals keep the $50 level firmly in focus for traders.

HYPE has returned to market attention as investors reassess its supply dynamics alongside real trading activity. The sharp change in token distribution comes at a time when competition among perpetual futures platforms remains intense, placing a premium on projects that combine liquidity, transparency, and disciplined issuance. Recent price action suggests growing confidence rather than a short-lived reaction.

Hyperliquid Reduces Team Token Unlocks And Near-Term Supply

Hyperliquid confirmed a major reduction in monthly HYPE releases allocated to core contributors. The February 2026 allocation dropped to roughly 140,000 tokens, compared with about 1.2 million released in January. Core contributors hold around 23.8% of the total one billion HYPE supply, subject to a one-year cliff and a 24-month vesting schedule, with releases occurring on the sixth day of each month.

More than 61% of the total supply remains locked, while circulating supply stands near 238 million tokens. This setup limits immediate dilution and eases sell-side pressure, a factor closely watched since HYPE entered the market through a community airdrop in November 2024. The adjustment reflects a broader shift across crypto projects toward tighter emission controls, as market participants increasingly favor sustainability over aggressive unlocks.

HYPE Price Action And On-Chain Activity Support The Rally

HYPE trades around $33.34, posting a 1.29% gain over the last 24 hours and holding most of its strong weekly advance. The token remains about 43% below its previous high of $59.30, leaving room for recovery if demand continues to build. Trading data suggests that interest extends beyond short-term spot speculation.

Open interest on the HIP-3 framework reached a record $790 million, rising from $260 million one month earlier, driven largely by commodities and Bitcoin futures trading. Hyperliquid founder Jeff Yan stated that Bitcoin futures liquidity on the platform surpassed Binance in selected order book comparisons. Since launch, Hyperliquid has processed more than $25 billion in cumulative trading volume, much of it generated by third-party teams building on HIP-3.

From a technical standpoint, HYPE recently reclaimed its 50-day moving average after months below it. The $28 to $29 area now acts as a key support zone. Holding that range keeps the path toward higher prices open, while a breakdown would weaken the current setup.