TL;DR

- Metaplanet approved a capital increase and raised 12.2 billion yen ($79.5 million), with the potential to reach up to $137 million.

- The offering included 24.53 million shares issued at a 5% premium and Series 25 warrants with a 15% premium, exercisable between February 2026 and February 2027.

- The company will allocate $91.2 million to Bitcoin purchases, $10.1 million to the Bitcoin Income business, and $33.8 million to partial debt repayment.

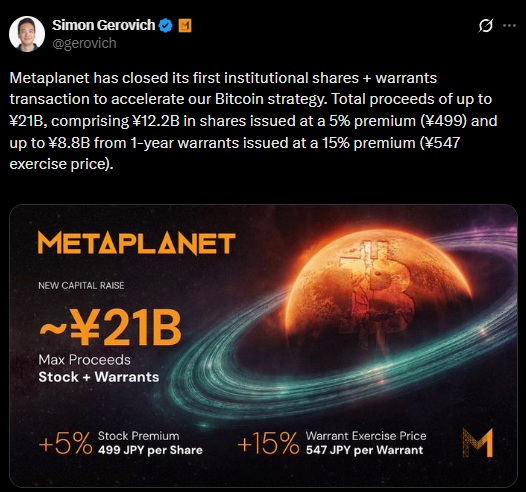

Metaplanet approved a capital increase aimed at financing the expansion of its Bitcoin treasury. The company completed an initial share issuance of 12.2 billion yen, equivalent to $79.5 million, and set up a structure that could raise total proceeds to as much as 21 billion yen, close to $137 million, through the exercise of one-year warrants.

The transaction included the issuance of 24.53 million common shares placed at a 5% premium. In parallel, Metaplanet issued Series 25 warrants that allow the purchase of additional shares at a 15% premium. These instruments can be exercised between February 16, 2026, and February 15, 2027, and if fully exercised would contribute up to an additional 8.8 billion yen, or about $57.3 million.

Metaplanet to Allocate $91 Million to Bitcoin Purchases

According to the disclosed details, the primary use of proceeds will be Bitcoin purchases. Metaplanet allocated approximately 14 billion yen, or about $91.2 million, to acquiring BTC between February 2026 and February 2027. The company uses the capital to increase its holdings under its Bitcoin treasury program, in place since April 2024.

A portion of the funds, equivalent to 1.556 billion yen ($10.1 million), will be allocated to the business unit known as Bitcoin Income. This unit generates revenue through derivatives and options trading on BTC. The company projects revenue of 8.58 billion yen, or roughly $57.8 million, from this line of business.

Another 5.186 billion yen, equivalent to $33.8 million, will be used for partial debt repayment. Metaplanet maintains a $500 million credit facility, of which it had drawn approximately $280 million as of January 28, 2026. The company used this facility to finance Bitcoin purchases and support its operating activity under tight market conditions.

Shares Decline in Tokyo and the United States

As of the end of December 2025, Metaplanet reported holdings of 35,102 Bitcoins, up from 1,762 BTC at the beginning of the same year. The company recorded a non-operating impairment loss of 104.6 billion yen, equivalent to $680 million, linked to Bitcoin price volatility.

Following the announcement, the company’s shares on the Tokyo Stock Exchange fell 4% to 456 yen. In the U.S. OTC market, the shares closed down 3% at $3.09.