TL;DR

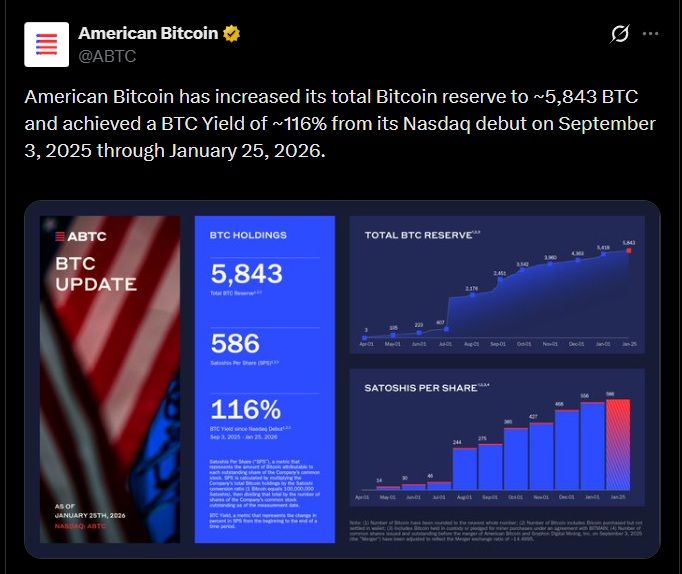

- American Bitcoin increased its holdings to nearly 5,843 BTC, becoming the 18th-largest corporate holder.

- Between September 2025 and January 2026, the company recorded a BTC yield of approximately 116%.

- The miner is 80% controlled by Hut 8 and 20% by Donald Trump Jr. and Eric Trump.

American Bitcoin raised its holdings to nearly 5,843 BTC, placing it as the 18th-largest corporate BTC holder globally, according to the company. Its accumulation strategy has been consistent and sustained since its Nasdaq debut on September 3, 2025.

From that date through January 25, 2026, the company reported an approximate BTC yield of 116%, a metric that reflects growth in total bitcoin reserves from mined or purchased BTC without issuing additional capital. During this period, the market experienced high volatility and significant price corrections, without slowing the miner’s accumulation pace.

At this reserve level, the company surpasses firms such as Nakamoto Inc. and GameStop Corp. The company is majority-controlled by Hut 8, which retains about 80% of the equity. Donald Trump Jr. and Eric Trump collectively hold roughly 20% of the capital. American Bitcoin became an independent entity after merging with Gryphon Digital Mining and spinning off from Hut 8’s mining operations.

American Bitcoin Down 11% Year-to-Date

In Tuesday premarket trading, the company’s shares rose around 2%, although they remain down roughly 11% for the year. This is partly due to btc prices falling below recent highs and a macro environment favoring traditional assets such as bonds and metals.

In its Q3 2025 earnings report, American Bitcoin posted a return to profitability and a significant revenue increase, driven by expanded mining capacity and higher BTC prices at certain stages of the cycle.

Since then, its BTC stock has grown by more than 1,800 coins. This accumulation strategy is being replicated by several crypto miners, who hold bitcoin as a long-term strategic reserve rather than liquidating it to fund ongoing operations