TL;DR

- Peter Schiff claimed that Bitcoin (BTC) is one of the worst-performing assets on Wall Street since most investors began buying it.

- Nate Geraci pointed out that BTC has risen nearly 90% since the launch of ETFs, outperforming the S&P 500.

- Over the past 12 months, silver gained 214% and gold 77%, while BTC declined 16%.

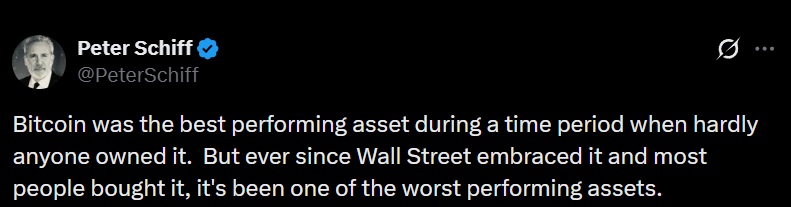

Peter Schiff again questioned Bitcoin’s (BTC) performance, stating that the cryptocurrency is one of the worst-performing assets on Wall Street. The economist said that since most investors began buying BTC, the asset has stopped being profitable and ranks among the worst in the market.

Nate Geraci, president of NovaDius Wealth Management, responded to these claims on X. The analyst highlighted that since the launch of Bitcoin ETFs, BTC’s price has risen nearly 90%, outperforming the S&P 500, which posted gains below 50% over the same period. Geraci noted that BTC ETFs broke all launch records and reflect institutional adoption of the cryptocurrency.

Silver and Gold Outperform Bitcoin

According to Santiment data, over the past twelve months silver rose 214% and gold 77%, while Bitcoin declined 16%. The data shows a rotation toward precious metals and a temporary pullback for the leading cryptocurrency. The supply of BTC ETFs has generated record volumes and allowed institutional and retail investors to access the cryptocurrency through regulated structures.

Over the past months, institutional accumulation of BTC has remained steady since late November last year. The presence of large investors ensures a consistent flow of capital into the market while BTC continues to record movements above traditional indices.

The Importance of BTC ETFs

2025 has been a year of volatility in crypto and precious metals markets. Silver and gold posted significant gains, while Bitcoin experienced larger fluctuations. ETFs enabled BTC to record positive figures against traditional equities, achieving a marked recovery since its debut.

The comparison between BTC performance and the S&P 500 shows that, despite Schiff’s claims of poor performance, market data demonstrates superior growth. Recent inflows, high trading volume, and institutional participation keep BTC at elevated and sustained activity levels.

Bitcoin is currently trading around $90,000. Its ETFs continue to provide liquidity and regulated market access, consolidating its position relative to traditional assets