After years of legal challenges and regulatory uncertainty, XRP recently completed one of its most notable recovery phases. However, renewed political discussion around digital asset regulation in the United States has introduced fresh uncertainty into the market.

This week, XRP came under moderate pressure following public comments from Ripple CEO Brad Garlinghouse supporting Donald Trump’s proposed CLARITY Act. The legislation aims to redefine parts of the U.S. crypto regulatory framework, and while some market participants view clarity as a long-term positive, short-term reactions have been more cautious.

Historically, digital asset markets tend to react defensively when regulatory or political narratives re-enter focus. For XRP, an asset with a long legal history, even indirect political alignment can influence sentiment as traders reassess near-term risk exposure.

XRP Price Outlook: Signs of Caution Rather Than Collapse

Recent trading data suggests that XRP is entering a consolidation phase rather than experiencing a decisive reversal. Trading volume has increased by roughly 10% to approximately $3.27 billion, while price action has stabilized near the $1.90 range following a gradual pullback.

Technical indicators highlight the $2.00 level as a key resistance zone. Market data also shows increased liquidations totaling roughly $861.9 million, largely from leveraged long positions, reflecting broader market de-risking rather than asset-specific panic.

Despite near-term price compression, on-chain metrics remain constructive. Certain measures of real-world asset (RWA) integration and network usage have expanded significantly, suggesting that underlying activity has not weakened in line with price movement.

Analysts generally note that the concern is not the content of the CLARITY Act itself, but uncertainty surrounding timing, interpretation, and political response. As a result, many expect XRP to continue ranging or consolidating as traders monitor major support levels and broader market direction.

Remittix (RTX): Utility-Driven Payments Attract Market Interest

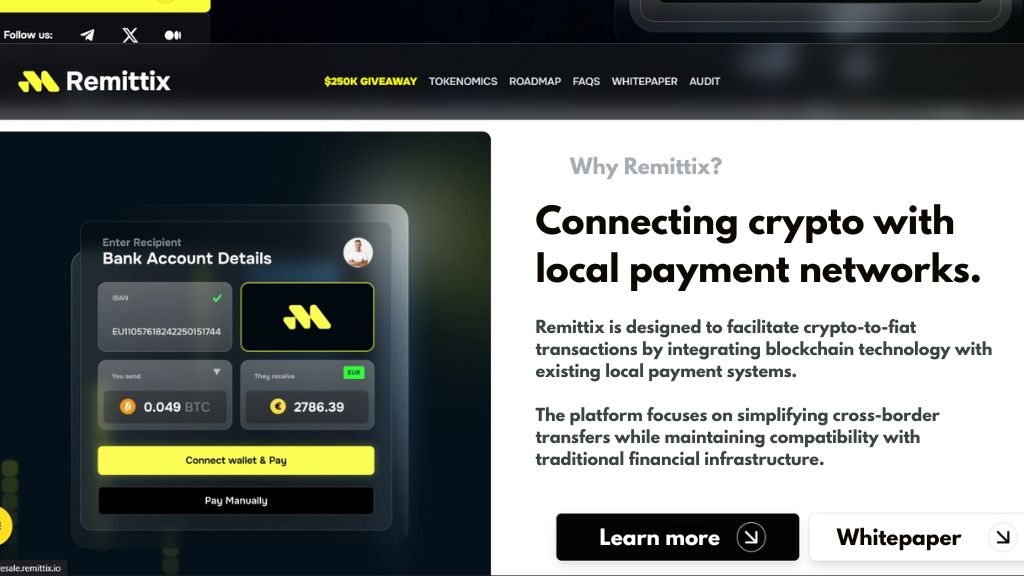

While XRP navigates regulatory discussion, Remittix (RTX) is gaining attention for a different reason: operational delivery. Rather than positioning itself around future regulatory outcomes, Remittix focuses on live infrastructure designed to bridge crypto and traditional banking systems.

The Remittix wallet is already available on the Apple App Store, with Google Play support expected soon. This availability is notable in a market where many projects remain pre-launch or roadmap-based.

Remittix is built to address a practical use case: enabling individuals and businesses to send cryptocurrency directly to real-world bank accounts with speed and transparency.

Key platform characteristics include:

-

Direct crypto-to-bank transfers

-

Support for over 30 fiat currencies and 40 cryptocurrencies

-

Borderless payment functionality

-

Real-time FX conversion with visible rates

-

Security audits conducted by CertiK

The PayFi platform is scheduled for rollout on February 9, 2026. For some market participants, RTX represents a utility-oriented alternative during periods when politically exposed assets face elevated uncertainty.

Final Perspective

XRP is not facing structural decline, but it is entering a period where market participants appear more selective. Ripple’s public stance on regulatory reform may prove beneficial over the long term, yet near-term trading behavior often reflects caution rather than conviction.

At the same time, projects like Remittix are drawing attention by emphasizing execution and real-world functionality rather than regulatory narratives. As volatility persists across major assets, diversification into platforms where value is tied to usage rather than headlines continues to shape investor behavior.

In the current market environment, delivery and infrastructure appear to be increasingly important signals.

Learn More About Remittix

Website: https://remittix.io/

Socials: https://linktr.ee/remittix

FAQs

Why did XRP react to comments supporting the CLARITY Act?

Markets tend to respond cautiously to political and regulatory developments, particularly for assets with a history of legal scrutiny. Uncertainty around timing and implementation often influences short-term sentiment.

Does the CLARITY Act end XRP’s broader market trend?

Not necessarily. Current price behavior reflects consolidation rather than a confirmed trend reversal. Traders continue to monitor support and resistance levels.

Is regulatory clarity important for XRP’s long-term outlook?

Clear regulatory frameworks are generally viewed as supportive for institutional adoption, but markets typically wait for implementation before pricing in long-term effects.

This article contains information about a cryptocurrency presale. Crypto Economy is not associated with the project. As with any initiative within the crypto ecosystem, we encourage users to do their own research before participating, carefully considering both the potential and the risks involved. This content is for informational purposes only and does not constitute investment advice.