TL;DR

- TRON ended 2025 as one of the largest stablecoin networks, with over $81 billion in total supply dominated by USDT.

- Daily transfer volumes have steadily increased, reflecting consistent real-world usage rather than speculative activity.

- Justin Sun’s recent statements highlight TRON’s growing role as a reliable blockchain for stablecoin payments, positioning the network as foundational infrastructure for crypto transactions worldwide.

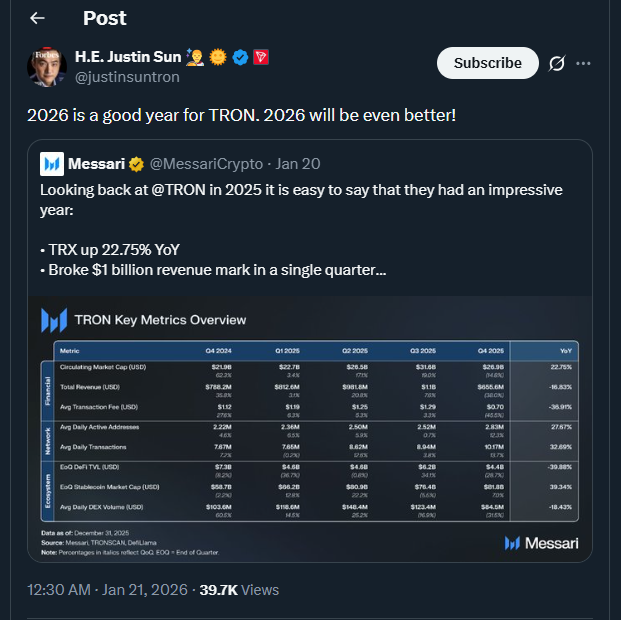

Justin Sun recently remarked that 2026 could be a pivotal year for TRON, pointing to sustained network activity and increasing relevance in stablecoin transfers. His comments suggest that TRON is evolving into a core infrastructure layer for digital payments rather than a blockchain driven primarily by speculation. Observers note that low transaction fees and fast settlement times have made TRON particularly attractive for high-volume stablecoin transactions across multiple regions.

Messari Data Shows Stablecoins Driving Network Strength

Data published by Messari underscores TRON’s expanding influence in the global stablecoin market. By the end of 2025, TRON hosted approximately $81.8 billion in stablecoins, with USDT accounting for $80.9 billion. Average daily USDT transfers reached roughly $23.8 billion, demonstrating ongoing usage for payments and settlements rather than sporadic spikes from trading activity. This positions TRON as one of the main blockchains for dollar-pegged transfers globally, emphasizing reliability and consistent throughput.

Network Metrics Reflect Broader Participation

Beyond stablecoin volumes, TRON’s core network metrics show solid growth. Daily active addresses and transaction counts increased significantly year on year, while quarterly revenue surpassed $1 billion. Although DeFi activity and decentralized exchange volumes showed modest declines, the network’s economic impact remains strong. This indicates that TRON’s current expansion is driven more by stablecoin payments than speculative DeFi activity, creating a more sustainable usage model.

Price Trends Remain Secondary to Usage

TRX token price action has been subdued compared with on-chain fundamentals, hovering around $0.30 after local highs. Technical indicators show limited momentum, suggesting that the market is processing gains while the network continues to facilitate substantial transaction volumes. This decoupling reinforces the idea that TRON’s value is increasingly defined by its role as a settlement layer rather than short-term price swings.

With strong on-chain metrics and stablecoin dominance, TRON is entering 2026 with a clear focus. The network appears set to reinforce its position as a global platform for stablecoin payments, with growth measured by transaction flow and revenue rather than speculative DeFi trends. If these patterns continue, TRON could emerge as a central infrastructure layer supporting broader crypto adoption worldwide.