The cryptocurrency market opened 2026 with renewed activity, as total market capitalization climbed above $3 trillion and daily trading volumes remained near $150 billion. Increased volatility has helped revive interest across both established and emerging digital assets. Monero (XMR) is showing signs of strength, while Solana (SOL) continues to attract attention for its network activity and ecosystem growth.

Despite this momentum, both Monero and Solana are widely held and already deeply integrated into the market. This has led some analysts to question how much upside remains for investors seeking higher-growth opportunities. As a result, attention has increasingly shifted toward early-stage blockchain projects with alternative pricing structures, including Zero Knowledge Proof (ZKP).

Market observers describe ZKP as a project where demand dynamics differ from traditional token launches. Its pricing structure is designed to adjust regularly, which some analysts believe may influence entry conditions over time as participation increases.

ZKP’s Auction-Based Model and Market Interest

Zero Knowledge Proof is being developed as a full blockchain network supported by significant self-funded capital, active test environments, and physical infrastructure components. Analysts note that projects entering the market with this level of preparation are relatively uncommon in early-stage auctions.

One of the main discussion points surrounding ZKP is its auction-based pricing model. Instead of a fixed token price, a set daily supply is released while demand fluctuates. Researchers tracking participation report steady growth in wallet activity, which has resulted in gradual price adjustments over time.

Analysts describe this pattern as a step-based repricing mechanism rather than a speculative surge. Each pricing reset reflects new participation levels, meaning similar investment amounts may result in smaller allocations as demand increases. This structure has drawn attention from market watchers evaluating how pricing mechanics can shape longer-term supply and demand balance.

While projections vary widely, analysts emphasize that outcomes depend on adoption rates, execution, and broader market conditions. As with any early-stage crypto project, timing and risk tolerance remain critical considerations.

Monero Price Update Shows Continued Stability

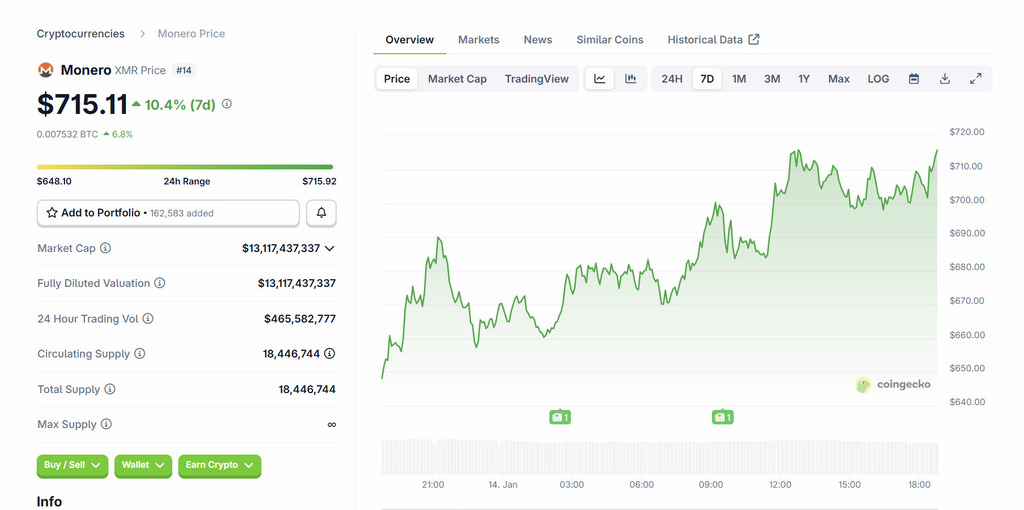

Recent Monero (XMR) price updates indicate continued momentum into January 2026. The token has been trading between $698 and $715 after moving above the $600 level earlier in the month. Monero’s market capitalization is now close to $13 billion, supported by daily trading volumes near $450 million and a circulating supply of approximately 18.4 million XMR.

Privacy-focused demand has contributed to renewed interest in Monero, which has recorded notable gains since early January. Analysts highlight that while XMR continues to serve a clear use case and maintains scarcity, its established market size means further growth may be more gradual compared to smaller assets.

Source: CoinGecko

Monero is often viewed as a stability-oriented option for investors prioritizing privacy and long-term network resilience rather than aggressive upside.

Solana Price Outlook Highlights Strength and Constraints

Solana (SOL) remains a key focus among large-cap cryptocurrencies. As of mid-January 2026, SOL has been trading in the $140 to $150 range following a volatile start to the year. Technical analysts point to resistance near $160, with potential movement toward higher levels if trading volume and network usage remain consistent.

Longer-term forecasts suggest moderate growth supported by Solana’s strong presence in decentralized finance, NFTs, and developer activity. However, analysts also note that Solana’s market capitalization, now above $70 billion, places natural limits on how quickly its valuation can expand.

For many investors, Solana is viewed as a mature network offering reliability and ecosystem depth, with expectations aligned toward steadier performance rather than outsized returns.

Zero Knowledge Proof Enters the Broader Market Discussion

When comparing Monero and Solana, analysts often highlight their proven track records and established roles within the crypto ecosystem. However, their maturity also means that significant gains typically require larger capital inflows and longer time horizons.

In contrast, Zero Knowledge Proof is drawing interest as an early-stage project shaped by a different participation model. Its regularly adjusted pricing and rising wallet activity have made timing a central topic among market participants. Analysts note that early engagement may offer different entry conditions than later participation, though outcomes remain dependent on execution and adoption.

As interest in privacy-focused and infrastructure-driven blockchain solutions continues to grow, Zero Knowledge Proof is increasingly mentioned in discussions around emerging crypto trends for 2026. Market experts emphasize that careful evaluation, rather than expectation of guaranteed returns, remains essential.

Explore Zero Knowledge Proof

Website: https://zkp.com/

Auction: https://auction.zkp.com/

X: https://x.com/ZKPofficial

Telegram: https://t.me/ZKPofficial

This article contains information about a cryptocurrency presale. Crypto Economy is not associated with the project. As with any initiative within the crypto ecosystem, we encourage users to do their own research before participating, carefully considering both the potential and the risks involved. This content is for informational purposes only and does not constitute investment advice.