TL;DR

- Spot XRP ETFs posted their first net outflow day since launch, ending a 36-day streak of steady inflows with roughly $41 million leaving the products.

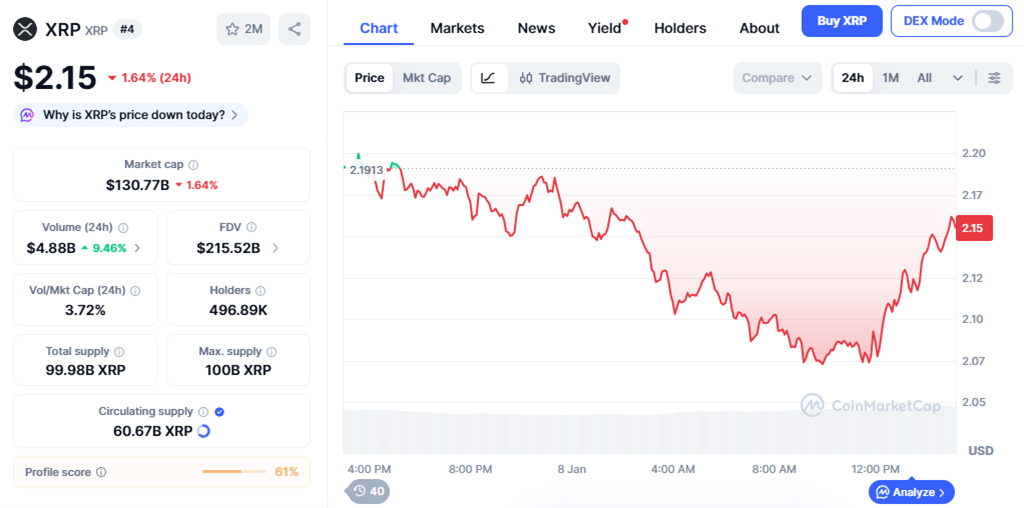

- XRP’s price eased modestly but held near $2.15, pointing to a controlled pullback rather than broad selling pressure.

- Total assets held by XRP ETFs remain above $1.5 billion, reinforcing the presence of sustained institutional exposure to the token.

XRP pulls back after spot ETFs record first day of net outflows, interrupting a prolonged period of positive flows. The shift added short-term pressure to price action while leaving the broader demand structure largely intact.

U.S. spot XRP exchange-traded funds recorded net outflows of about $40.8 million, marking their first negative session since launching in November. The reversal followed 36 consecutive days of inflows, a period that positioned XRP ETFs among the most active crypto-linked products outside Bitcoin and Ether.

According to SoSoValue data, most of the withdrawals stemmed from a $47.25 million redemption at 21Shares’ TOXR fund. This was partially offset by inflows into other vehicles, including $2.32 million into Canary’s XRPC and $1.69 million into Grayscale’s GXRP. Even after the outflows, total assets held across spot XRP ETFs remain near $1.53 billion, equivalent to around 1.16% of XRP’s total market capitalization.

Price reaction stayed measured. XRP briefly traded below $2.10 before stabilizing and now changes hands at $2.15. The token shows a 1.64% decline over the last 24 hours, while its market capitalization stands at $130.77 billion. The limited downside suggests that ETF-related selling did not trigger widespread liquidation.

Wider Crypto ETF Trends And Market Signals

The pullback in XRP ETFs aligned with broader shifts across crypto investment products. Spot Bitcoin ETFs saw nearly $486 million in outflows in a single session, led by large redemptions from Fidelity and BlackRock funds. Spot Ether ETFs also turned negative, posting about $99 million in net outflows after several positive sessions earlier in the year.

Despite these movements, underlying market indicators remain constructive. On-chain data shows XRP exchange balances at relatively low levels, signaling continued movement toward self-custody by long-term holders. In parallel, improved regulatory clarity in the U.S. around XRP-related products has reduced uncertainty for asset managers and institutional participants.

The first outflow day for spot XRP ETFs appears to reflect short-term rebalancing rather than a structural shift.