TL;DR

- BlackRock clarifies that Bitcoin and Ethereum are “early” in terms of institutional adoption, not valuation levels.

- Most pension funds, insurers, and sovereign portfolios still hold zero direct exposure to BTC and ETH.

- With Bitcoin at $90,094 and Ethereum at $3,137, recent price declines reflect market cycles, not stalled adoption.

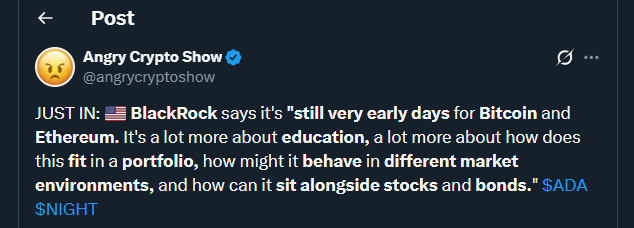

Bitcoin and Ethereum continue to sit at the center of global crypto markets, but BlackRock is urging investors to rethink what “early” really means. Recent comments from the asset manager underline a structural argument about adoption rather than price expectations, offering a longer-term lens on digital assets.

Bitcoin and Ethereum often appear mature due to their scale, liquidity, and global recognition. However, market size does not equal full integration into traditional finance. The gap between active trading and long-term institutional allocation remains significant, even after years of market development.

Bitcoin And Ethereum In Institutional Allocation

When BlackRock executives describe Bitcoin and Ethereum as early-stage assets, they are referring to their position inside institutional portfolios. Across pensions, insurance companies, and sovereign funds, exposure to crypto remains close to zero in most cases. This is driven less by skepticism and more by governance rules, internal risk limits, and regulatory processes that evolve slowly.

Even after the approval of spot Bitcoin ETFs in the United States, adoption has been selective rather than universal. These products reduced operational barriers and simplified custody, yet many institutions still require long evaluation cycles before introducing new asset classes. Compared with equities or fixed income, Bitcoin and Ethereum remain peripheral in strategic allocation models.

This pattern mirrors earlier financial instruments. ETFs and index products existed for years before becoming default portfolio components. Crypto infrastructure is now largely in place, but large-scale capital typically follows infrastructure with a delay.

Price Action Versus Adoption Timelines

Market prices tend to move faster than institutions. Bitcoin trades at $90,094 after a 1.63% decline over the last 24 hours, while Ethereum stands at $3,137, down 3.27% over the same period. These moves reflect liquidity conditions and macro risk sentiment rather than changes in long-term adoption trends.

Institutions rarely react to short-term volatility. Capital allocation decisions move through committees, benchmarks, and policy reviews, processes measured in years rather than days. As a result, adoption curves often lag price discovery, even in liquid and widely traded markets like Bitcoin and Ethereum.