TL;DR

- Stablecoin usage in Europe grew throughout 2025, with more than 113 million transactions compared with 44 million recorded in 2024.

- Activity remained strong all year: although volumes cooled from early peaks, Europe ranked among the regions with the highest usage of these assets.

- Roughly 80% of trading relies on stablecoins. Nine banks are moving forward with Qivalis, a euro-denominated stablecoin expected to launch in mid-2026.

Stablecoin usage in Europe expanded sharply during 2025, even as a stricter and more punitive regulatory framework came into force.

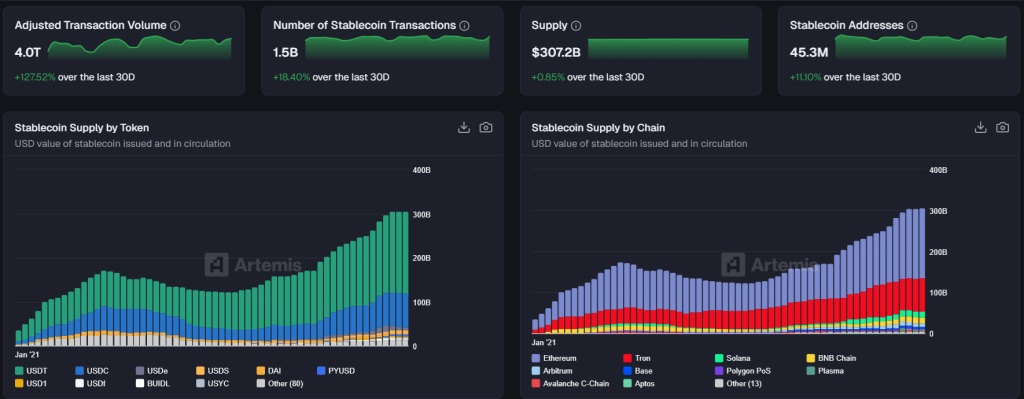

Ethereum and Solana accounted for most of the activity. Onchain data shows more than 113 million transactions processed during European trading hours over the year, excluding December. In 2024, the total stood at just over 44 million.

The Market Moves Forward Despite New European Regulations

Activity stayed elevated throughout the year. While volumes fell from the peaks seen in early 2025, usage levels remained well above those of previous cycles. Europe ranked among the most active regions for stablecoin usage.

The surge in activity coincided with the rollout of MiCAR rules. The framework restricted key features, including interest payments on stablecoins, and tightened issuance and oversight requirements. Despite those constraints, the market continued to advance. Stablecoins retained their central role within Europe’s crypto market.

Currently, close to 80% of trading volume on centralized exchanges is conducted using stablecoins. In the continent, these assets serve as an entry and exit point between fiat currencies and crypto assets, a settlement instrument, and a unit of account in day-to-day financial activity.

Several Banks Are Working on a Regulated Stablecoin

The European Central Bank addressed the growth of stablecoins in its Financial Stability Review. The institution highlighted risks linked to potential bank deposit outflows, particularly if these instruments were to offer yields. Still, this warning did not alter the level of activity observed during the year.

At the same time, part of the banking system moved in the opposite direction. A consortium of nine banks is developing Qivalis, a MiCAR-compliant euro stablecoin designed for cross-border payments and 24/7 settlement. Its launch is scheduled for the second half of 2026