TL;DR

- Ethereum gained 2.75%, outperforming Bitcoin and other major cryptocurrencies.

- A whale withdrew over $6.5M in ETH from an exchange, signaling accumulation.

- The price chart shows a bullish cup-and-handle pattern, targeting a move toward $3,360.

On December 29, Ethereum (ETH) advanced 2.75% and outperformed Bitcoin (BTC), Ripple (XRP), BNB, and Solana (SOL) during the session. The broader crypto market gained 2.32%, pushing total capitalization back above $3 trillion. Short-term gauges pointed to accumulation, higher participation, and a technical setup that supports continuation.

A single event drew attention. Whale wallet “0xcd9” withdrew 2,218 ETH worth $6.52 million from Kraken, according to Onchain Lens. Nineteen days earlier, the same address received 519 ETH valued at $1.62 million from Wintermute. At report time, holdings stood at 2,738 ETH worth $8.07 million. Exchange outflows cut near-term supply and often accompany accumulation phases.

A whale withdrew 2,218 $ETH ($6.52M), 37.1M $SKY ($2.36M), and 4,772 $AAVE ($730.36K) from #Kraken 7 hours ago.

The wallet received 519 $ETH ($1.62M) from #WinterMute 19 days ago. In total, it holds 2,738 $ETH ($8.07M).

Address: 0xcd9eb5783e2620762f47bf0a7d09c531225b5507 pic.twitter.com/lOcDwtgec8

— Onchain Lens (@OnchainLens) December 29, 2025

CoinMarketCap recorded a 130% jump in 24-hour ETH volume to $17.16 billion, signaling a return of flow from traders and investors.

The daily chart outlines a formation, common in continuations after recoveries. Based on the measured move, a daily close above $3,050 could open room toward $3,360, near 10% from breakout marks. The Average Directional Index (ADX) printed 29.09, above the 25 threshold, which signals trend strength during the rebound.

Derivatives desks aligned with the ETH bullish bias

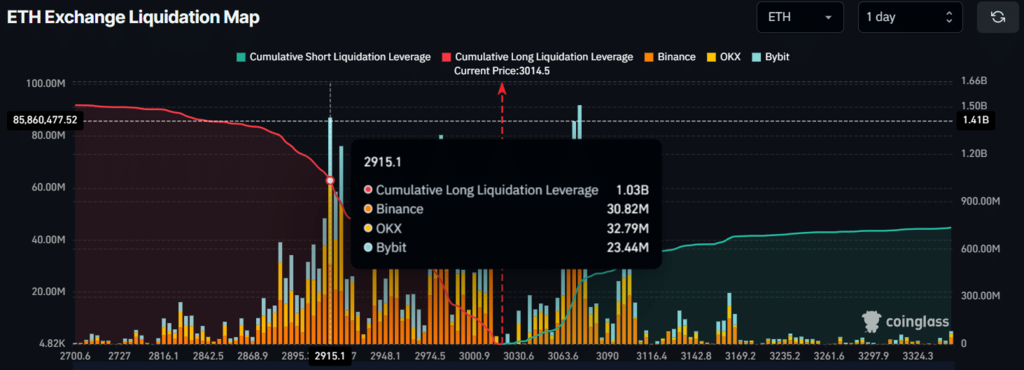

CoinGlass showed key levels at $2,915.1 (support) and $3,073.5 (resistance). Around those prices, the market built $1.03 billion in Cumulative Long Liquidation Leverage and $380.58 million in Cumulative Short Liquidation Leverage, levels that can accelerate moves when price tags liquidation triggers.

Bybit led with 9,398 ETH withdrawn. Gemini followed with 5,186 ETH. Binance posted a net outflow of 2,260 ETH while handling the largest overall whale volume, a mix of inflows and outflows that still pointed to a net accumulation backdrop. The pattern extended to Kraken, OKX, Upbit, and Crypto.com, with net withdrawals ranging from 165 to 1,140 ETH.

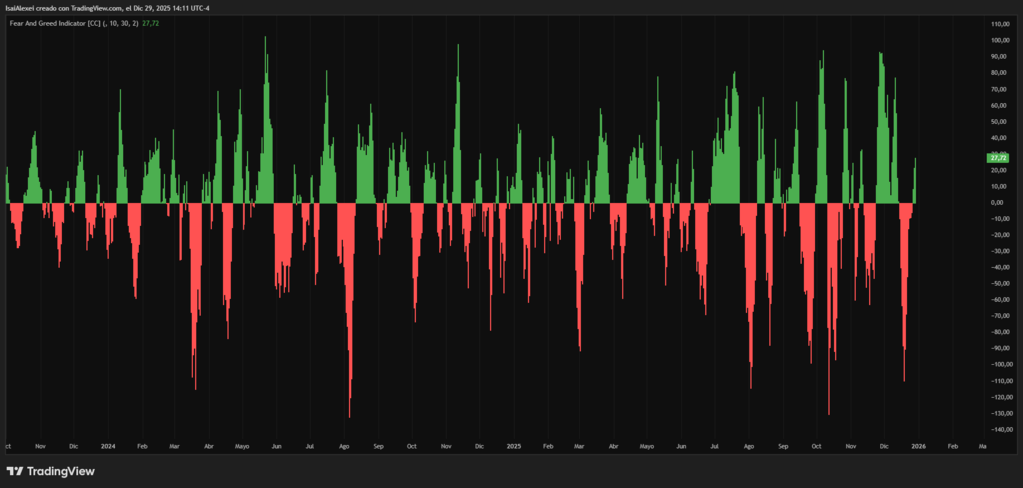

The Fear & Greed Index fell to 27, a mark of elevated fear among retail traders. Long-term holders also slashed exchange deposits during December, a stance aligned with supply retention and a cooler pace of forced selling.

The near-term chart combines whale accumulation, rising liquidity, and a structure that sustains momentum. While ETH defends the $3,000 area, market focus centers on $3,050 as a pivot for continuation and $2,915.1 as the protective valve. A break with strong volume above the neckline would validate the buy signal; a loss of support would reopen the range and raise the risk of long liquidations.