TL;DR

- Ethereum recorded 8.7 million contracts in the fourth quarter of 2025, an all-time high that reflects real network usage and an expansion in on-chain development.

- The increase was supported by ETH ETFs, a surge in active addresses, and higher demand for contracts across DeFi, applications, and financial services.

- ETH’s price fell 27.6% during the quarter, marking a clear disconnect between network activity and the market.

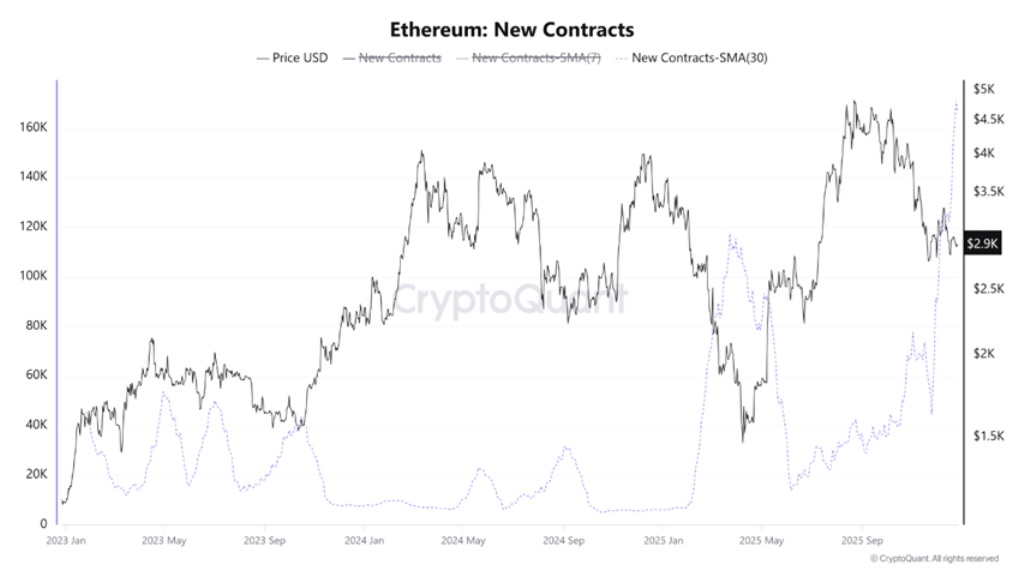

Ethereum recorded 8.7 million smart contracts deployed in the fourth quarter of 2025, an all-time high for the network. The 30-day moving average reached 171,000 contracts, confirming that the network is undergoing a steady expansion in on-chain development and the effective use of its infrastructure.

Factors Behind Ethereum’s Growth

The growth is tied to several factors. The approval of ETH ETFs increased activity across the DeFi ecosystem and strengthened institutional participation. Active addresses rose from 396,439 to more than 610,000 so far this year, according to Etherscan data. That increase pushed demand for contracts used by applications, protocols, and financial services.

Layer 2 solutions also played a central role. Arbitrum, Optimism, and Base reduced gas costs and expanded throughput, removing technical constraints on contract deployment. Development stopped concentrating solely on the base layer and spread across a more scalable environment, while remaining anchored to Ethereum.

Usage is also concentrated in clearly defined sectors. DeFi, NFTs, GameFi, and restaking account for most new contracts. These are active systems that require audited contracts, ongoing updates, and continuous operation. Ethereum holds a privileged position due to its tooling ecosystem, developer base, and liquidity.

The Market Does Not Follow

However, price action did not track the expansion. ETH fell roughly 27.6% during the fourth quarter and traded below $3,000 for most of the period. Exchange reserves increased by more than 400,000 ETH in December, signaling higher distribution and selling pressure. Whale activity and institutional flows amplified that dynamic in the short term.

The disconnect between Ethereum’s activity and its price is clear. The network processes more contracts, more users, and more applications than in any previous cycle, yet the market remains in a corrective structure. Some analysts argue that without a solid recovery in Bitcoin, Ethereum is unlikely to set new highs in 2026