TL;DR

- Trend Research purchased 46,379 ETH, raising its treasury to 580,000 ETH and becoming one of the largest Ethereum holders.

- BitMine holds over 4 million ETH, plans to reach 5% of the circulating supply, and will stake a large portion to earn yields and maintain control in the PoS consensus.

- ETHZilla and FG Nexus sold ETH to pay debt and fund buybacks, transferring value to strategic buyers seeking influence over the network.

Trend Research has emerged as one of Ethereum’s largest holders following a quiet purchase of 46,379 ETH, bringing its total holdings to approximately 580,000 ETH.

This acquisition places the firm only behind SharpLink Gaming (859,853 ETH) and BitMine Immersion Technologies (4,066,062 ETH). As a private company, Trend Research does not appear in most Ethereum treasury rankings.

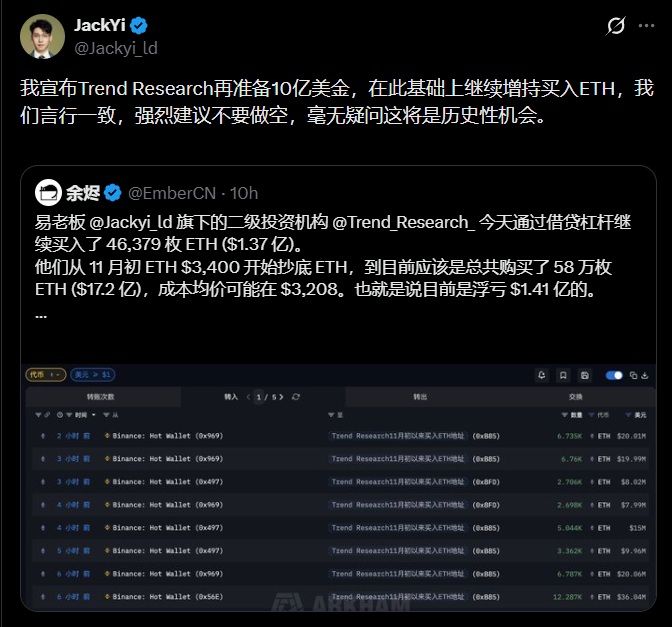

Trend Research to Allocate an Additional $1 Billion to Ethereum

The institution is associated with Jack Yi, founder of LD Capital, who has led a series of large ETH purchases since October. According to a recent post by Yi, the firm plans to deploy another $1 billion to continue buying Ethereum and also advises traders not to open short positions.

For companies, buying ETH at lower prices is not simply “dip buying.” According to Lacie Zhang, analyst at Bitget Wallet, these acquisitions turn passive treasuries into productive, yield-generating infrastructure and represent a strategy to secure influence within the Ethereum network.

From Holding to Staking

BitMine exemplifies this approach: its treasury surpassed 4 million ETH, over 3.3% of the circulating supply, and plans to increase its holdings to reach 5%. A large portion of these assets will be staked through its Made in America Validator Network, generating yields and strengthening participation in Ethereum’s proof-of-stake consensus. This approach lowers the average acquisition cost of ETH and ensures consistent validation rewards.

Not all treasuries are moving in the same direction. ETHZilla sold 24,291 ETH (~$74.5 million) to repay debt, leaving around 69,800 ETH, and FG Nexus, a US-listed finance and insurance company, liquidated ETH to fund share buybacks. Zhang notes these sales represent a transfer of wealth from distressed entities to strategic buyers aiming to control the network’s future infrastructure.

Trend Research and other institutions are not only seeking short-term returns but also aim to influence Ethereum governance and staking, securing their role in the network’s infrastructure for the coming years