TL;DR

- Mike McGlone analyzed the Bitcoin-to-gold ratio and argues that the focus should not be on the USD price, but on BTC’s real purchasing power against gold.

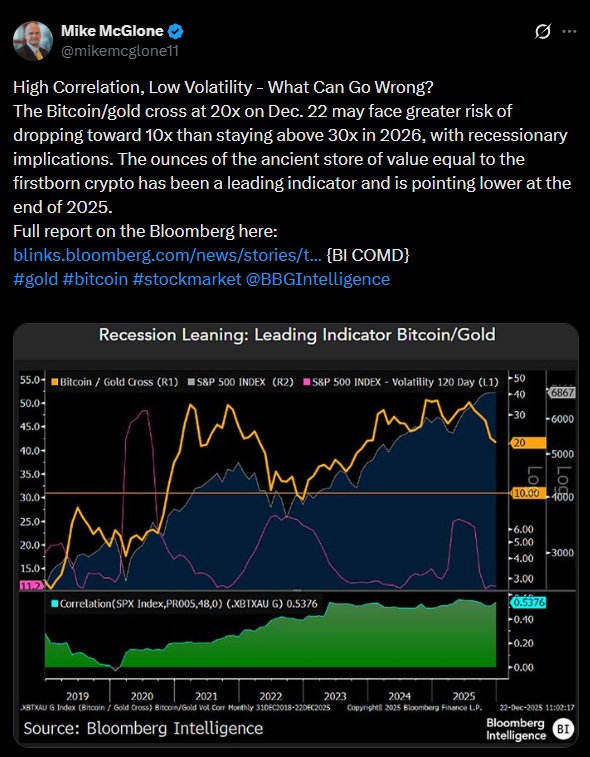

- The BTC/gold ratio is hovering around 20x, and McGlone sees a move toward 10x in 2026 as more likely, implying a relative loss of close to 50%.

- A correlation near 0.54 with equities and volatility shows that BTC continues to trade as a risk asset rather than as a store of value.

Mike McGlone, senior commodity strategist at Bloomberg Intelligence, shared an analysis of a metric that often goes unnoticed in the crypto market: the relationship between Bitcoin and gold. His premise does not revolve around BTC’s price in dollars, but around how much gold one bitcoin can actually buy. From that perspective, he points to further relative value erosion heading into 2026.

At present, the BTC/gold ratio sits near 20x. According to McGlone, the more likely scenario is not a rise toward 30x, but a correction down to 10x. If that were to materialize, it would represent a drop of roughly 50% in Bitcoin’s purchasing power when measured against gold. This adjustment might not appear as dramatic on the USD chart, but it would reflect a real loss versus a historically defensive asset.

McGlone notes that the Bitcoin-to-gold cross often acts as a leading indicator of economic stress. In past cycles, when recession risks increased, this ratio tended to compress. For that reason, Bloomberg tracks it alongside the S&P 500 and volatility indices, as they tend to display similar behavior during periods of market adjustment.

Bitcoin Does Not Trade as a Safe Haven

The correlation between equities, volatility and the BTC/gold ratio remains close to 0.54. This suggests that Bitcoin continues to move within the same “risk-on” asset cluster, aligned more with risk appetite than with a safe-haven role. In that context, a slowdown in traditional markets would have a direct impact on its relative valuation against gold.

McGlone also outlines a macro scenario consistent with a cycle-level reset in 2026. He points to core inflation trending toward 1%, oil prices near $40, and gasoline around $2. Under those conditions, BTC could trade close to $50,000. These are not precise targets or fixed timelines, but levels that have historically appeared when markets complete normalization processes.

As long as the market continues to treat Bitcoin as part of the same basket as equities and other risk assets, its performance versus gold will remain a key signal. For McGlone, that signal currently points to downside pressure and a pending relative adjustment, regardless of the narrative dominating the dollar price