TL;DR

- Bitcoin trades in a tight range with low liquidity, marking its weakest year-end in seven years.

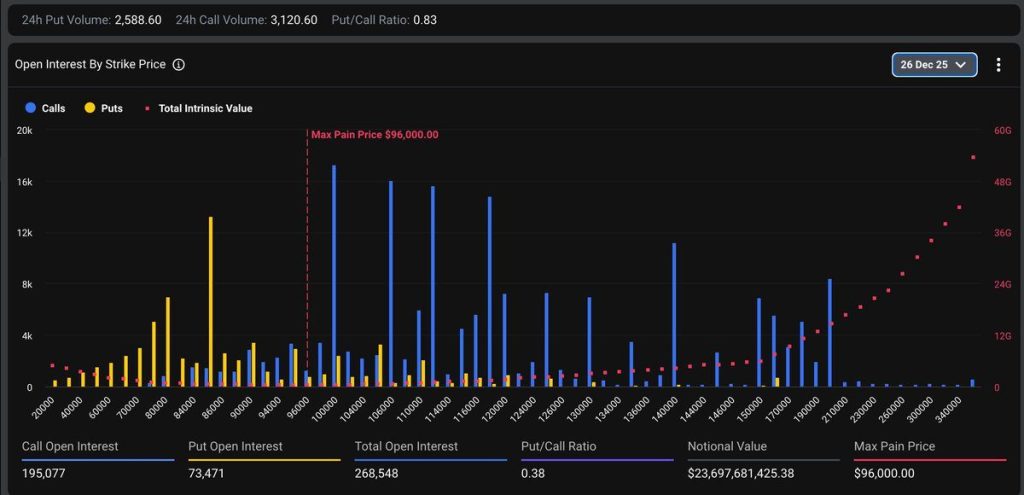

- Massive $23.7B Bitcoin options expire on December 26, creating potential volatility.

- Institutional holders appear patient, with spot ETFs shedding less than 5% of total holdings.

Bitcoin continues to trade in a tight range heading into the Christmas period, with reduced liquidity and risk-off sentiment driving traders to cut exposure. According to QCP Capital, open interest in perpetual futures fell by $3 billion for BTC and $2 billion for ETH overnight, signaling a retreat from leverage ahead of the holidays. Crypto Economy analysts warn that thin conditions could lead to sudden price swings, even as positioning lightens.

Gold, by contrast, has outperformed sharply, gaining 67% year-to-date and setting new all-time highs, while Bitcoin remains locked between $85,000 support and $93,000 resistance. QCP described it as the weakest year-end performance for Bitcoin in seven years, as the asset struggles to break free from consolidation.

The pressure builds before Friday’s record Boxing Day options expiry, when roughly 300,000 Bitcoin options worth $23.7 billion and 446,000 IBIT options come due — together representing more than half of Deribit’s total open interest.

Current options positioning shows $85,000 put contracts declining from 15,000 to 12,000, while $100,000 calls remain steady near 17,000, hinting at limited but lingering optimism for a short-term rally.

Year-End Flows Heighten Volatility Risk

According to QCP, Bitcoin risk reversals suggest bearish sentiment has eased, with positioning returning toward pre-October levels as traders unwind downside hedges. However, tax-loss harvesting ahead of December 31 may still fuel volatility, since crypto investors can realize losses and re-enter positions immediately, unlike in equity markets where wash-sale restrictions apply.

QCP added that holiday-driven market moves often reverse, noting that Christmas-week volatility tends to fade in early January once liquidity returns. This pattern, they said, mirrors “low-volume weekend spikes that retrace once markets reopen.”

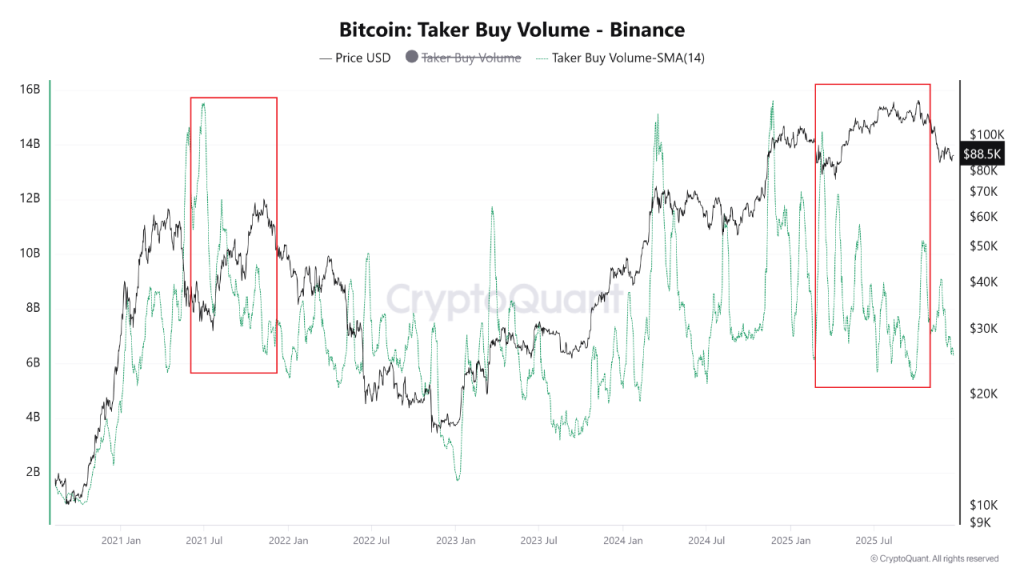

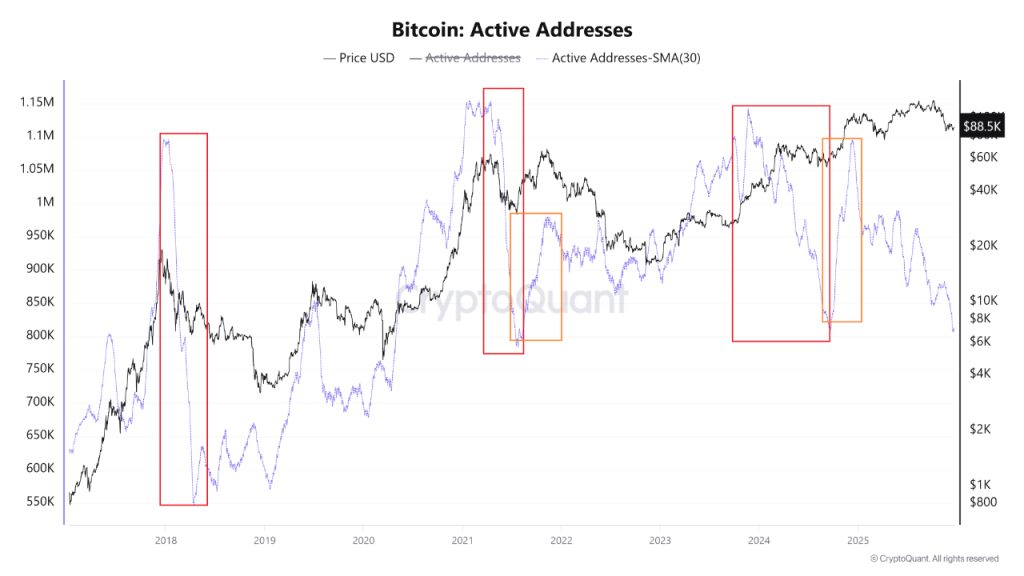

Beyond derivatives, on-chain indicators point to declining momentum. CryptoQuant data highlight a drop in buy-volume divergence on Binance futures markets, echoing late-stage 2021 conditions, when prices climbed while trading volume steadily fell. Meanwhile, active Bitcoin addresses are decreasing, a sign of waning participation in both on-chain OTC flows and retail trading activity.

ETF flows reflect similar fatigue. Over the past three days, Bitcoin ETFs have seen $461.8 million in outflows, led by BlackRock ($173.6 million) and Fidelity ($170.3 million). Analysts attribute the pullback to year-end de-risking rather than fundamental shifts in institutional positioning.

Institutional Holders Remain Steady

Despite a 30% drawdown from October highs, data show that U.S. spot Bitcoin ETFs have shed less than 5% of total holdings, suggesting that institutional investors remain patient through short-term turbulence.

Ray Youssef, CEO of NoOnes, told that current selling “is primarily retail-driven by leveraged and short-term participants.” He noted that Bitcoin has “not behaved like digital gold in 2025,” reacting more to liquidity shifts and policy expectations than to inflation narratives.

Complementing this, Farzam Ehsani, CEO of VALR, described the period as “one of the more challenging year-ends for crypto,” citing seasonal weakness, overbought conditions, and renewed investor preference for U.S. government bonds.

Ehsani outlined two potential outcomes: either large holders are positioning ahead of renewed accumulation, or the market is undergoing a deeper reset shaped by macroeconomic headwinds and Federal Reserve policy.