TL;DR

- Foundations & Ecosystem: Midnight (NIGHT) launched strongly with tier-one exchange listings, dual-resource utility (NIGHT + DUST), and a roadmap focused on privacy and cross-chain adoption.

- Market Dynamics: Unlock cycles, liquidity absorption, and enterprise traction shape short-term volatility while reinforcing long-term growth potential.

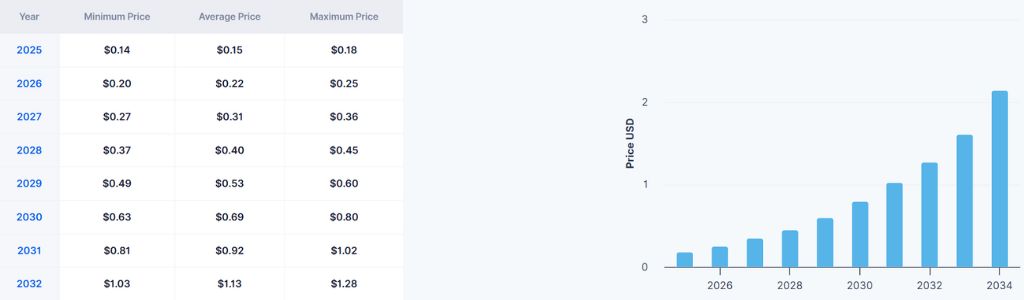

- Price Predictions 2026–2032: Forecasts highlight volatility but consistent upward potential, with NIGHT projected to range from fractions of a cent to above $1.28, signaling resilience and opportunity.

Midnight (NIGHT) entered the market with one of the strongest debuts for a Cardano-native asset. Coordinated listings across tier-one exchanges such as Bybit, KuCoin, OKX, and Kraken provided immediate depth, while millions of wallets claimed tokens across multiple chains. This rare combination of liquidity and distribution established a robust foundation for price discovery, even as profit-taking moderated the initial surge. The early trading phase highlighted both the potential of the asset and the challenges of sustaining momentum after a rapid breakout.

Distribution Pressure and Unlock Cycles

The Glacier Drop airdrop introduced a significant supply dynamic, with billions of tokens scheduled to unlock in staggered phases. This randomized release mechanism was designed to avoid concentrated sell-offs, yet it ensured that steady inflows of supply would remain a defining factor for the market. Liquidity from major exchanges helps mitigate shocks, but absorption capacity continues to shape short-term performance. The balance between unlock pressure and network growth remains central to Midnight’s trajectory.

Dual-Resource Ecosystem

Midnight operates with a distinctive two-resource model. NIGHT functions as the tradable utility token, while DUST serves as a shielded, decaying resource that powers privacy-centric transactions. This structure prevents speculation on gas fees and ensures predictable monetary behavior, positioning the ecosystem as a stable environment for developers. By requiring ongoing participation, DUST reinforces the network’s privacy guarantees and supports sustainable application growth.

Roadmap and Enterprise Adoption

Midnight’s upgrade path extends its utility beyond Cardano, introducing cross-chain bridges and federated mainnet capabilities. Enterprise traction, including partnerships with major cloud providers and regulated industries, underscores its ambition to deliver compliance-ready privacy solutions. Success will depend on scaling zero-knowledge systems and meeting integration milestones, shaping long-term demand through both retail and institutional adoption.

Midnight (NIGHT) 2026 to 2032 Price Prediction

2026: Early Market Signals and Growth Potential for Midnight

In 2026, analysts at CoinCodex project that NIGHT could trade within a channel ranging from $0.06368 to $0.2431, establishing an average annualized price of $0.1066. This trajectory suggests a potential return on investment of 219.70%, positioning NIGHT as a cryptocurrency with notable upside for investors who are willing to navigate its volatility.

Complementing this outlook, technical analysis indicates that NIGHT may experience significant momentum as the next halving event approaches. Projections suggest a possible peak price of $0.286419, supported by historical market patterns and technical indicators. Alongside this peak, the average price is expected to hover around $0.255731, with a minimum forecast of $0.225043.

Youtubers Price Prediction

Bitcoin Strategy, a well-known Cryptocurrency YouTube Channel, shared a video predicting Midnight’s potential price movement for early 2026, discussing a possible scenario and how the token would react to certain market conditions.

2027: Adoption Trends and Investor Confidence Around Midnight

CoinDataFlow’s experimental model suggests that NIGHT could face significant downside pressure in 2027, with projections indicating a potential decline of 52.11%. Under this scenario, NIGHT’s value may reach as low as $0.0002012 in the best case, while trading is expected to fluctuate between $0.0002012 and $0.000076 throughout the year.

NIGHT’s role as a privacy layer across major blockchain networks is expected to become more tangible by 2027. If programmable selective disclosure is successfully deployed and cross-chain traffic continues to expand, NIGHT could climb into the $0.090–$0.140 range, reflecting stronger utility and adoption. Conversely, failure to capture multi-chain flows may limit its valuation to a narrower band of $0.060–$0.085.

2028: Volatility Challenges and Regulatory Shifts Impacting Midnight

According to DigitalCoinPrice, 2028 could mark a pivotal year for NIGHT, with forecasts suggesting the possibility of its value doubling compared to previous levels. Analysts predict that NIGHT may reach an all-time high between $0.40 and $0.45, though there remains uncertainty about whether it can fully achieve the upper threshold.

Further projections highlight the impact of global adoption on NIGHT’s valuation. With increasing recognition of its utility across nations, NIGHT is estimated to reach a potential price ceiling of $0.491004 in 2028. The average price for the year is expected to hover around $0.460316, with a minimum forecast of $0.429628.

2029: Utility Expansion and Ecosystem Development Driving Midnight’s Value

Experimental price simulations suggest that NIGHT could experience a notable upswing in 2029, with projections indicating a rise of approximately 60.50%. Under the best-case scenario, NIGHT’s value may reach $0.000998, while forecasts place its trading range between $0.000998 and $0.0003036 throughout the year.

Beyond numerical simulations, the broader outlook for NIGHT in 2029 is tied to the evolution of its privacy infrastructure and cross-chain engagement. If these systems mature and adoption expands, NIGHT could establish itself within the $0.140–$0.220 range, reflecting stronger utility and institutional interest.

2030: Technological Advancements Shaping Midnight’s Market Trajectory

In 2030, forecasts suggest that NIGHT could trade within a channel ranging from $0.1461 to $0.3638, establishing an average annualized price of $0.2191. This projection implies a potential return on investment of 377.93% compared to current market rates, highlighting the strong upside potential for long-term investors.

Technical analysis further reinforces this optimistic outlook, pointing to a potential maximum price of $0.695589 for NIGHT in 2030. Alongside this peak, the average price is projected to hover around $0.664901, while the minimum forecast sits at $0.634213. These figures highlight the possibility of NIGHT consolidating at higher levels.

2031: Institutional Interest and Market Maturity for Midnight

Experimental price simulations suggest that NIGHT could experience a notable increase in 2031, with projections indicating a rise of approximately 57.16%. Under the most optimistic scenario, NIGHT’s value may reach $0.000681, while forecasts place its trading range between $0.000681 and $0.0003053 throughout the year.

Technical analysis further supports the potential for an upward trend in 2031, with NIGHT projected to reach a peak of $0.797881 and establish new resistance levels. Alongside this peak, the average price is estimated at $0.767194, while the minimum forecast sits at $0.736506.

2032: Future Horizons and Strategic Positioning of Midnight

Forecasts for 2032 suggest that NIGHT could cross an average price level of $1.13, supported by technical analysis and market expectations. By the end of the year, the minimum price is projected to be around $1.03, while the maximum price could reach as high as $1.28.

Complementing this perspective, additional forecasts indicate that NIGHT may commence the next decade with a potential peak price of $0.900174, alongside a minimum projection of $0.838798. The average price for 2032 is estimated at $0.869486, derived from technical indicators and prevailing market trends.

Conclusion

Midnight (NIGHT) demonstrates strong foundations, innovative dual-resource utility, and ambitious cross-chain adoption goals. Despite volatility and unlock pressures, forecasts highlight consistent growth potential through 2026–2032. With enterprise traction and advancing privacy infrastructure, NIGHT’s trajectory suggests resilience and opportunity, positioning it as a competitive asset in the evolving crypto landscape.

The Price Predictions published in this article are based on estimates made by industry professionals; they are not investment recommendations, and it should be understood that these predictions may not occur as described.

The content of this article should only be taken as a guide, and you should always carry out your own analysis before making any investment.