Hedera deepens its weakness after the collapse in ETF demand, leaving HBAR exposed to a break below key levels. The token trades near $0.111, under sustained selling pressure and facing reduced institutional interest.

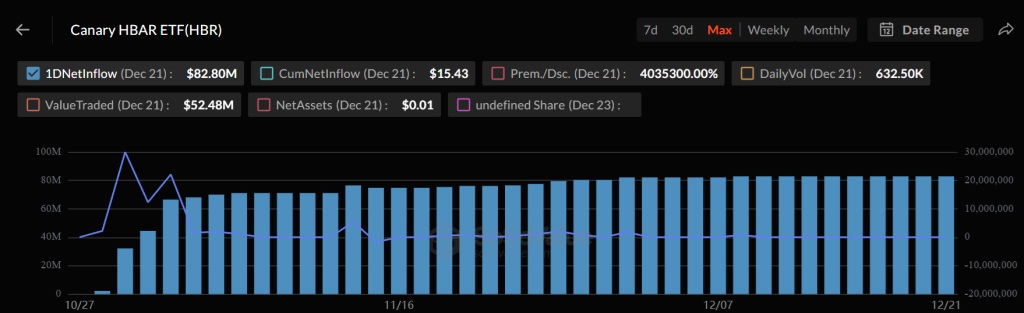

Data from the Canary HBAR ETF shows zero net inflows less than two months after its launch. The complete absence of inflows points to very limited appetite from both crypto-native and traditional investors, diluting one of the main bullish catalysts that had supported the token. Without institutional flows, HBAR loses a crucial buffer against selling pressure, reinforcing the view that the initial ETF enthusiasm was largely speculative.

From a technical perspective, HBAR remains below the $0.120 resistance and has spent more than six weeks in a downtrend. Immediate support sits at $0.110. A clear break below that level could open the door to a move toward the $0.099 area. If support holds, the price could enter a sideways phase, though still without clear signs of demand.

Source: https://sosovalue.com/bigChart/Etf_NASDAQ_HBR?title=Canary%20HBAR%20ETF(HBR)&coin=undefined

Disclaimer: Crypto Economy Flash News are based on verified public and official sources. Their purpose is to provide fast, factual updates about relevant events in the crypto and blockchain ecosystem.

This information does not constitute financial advice or investment recommendation. Readers are encouraged to verify all details through official project channels before making any related decisions