TLDR

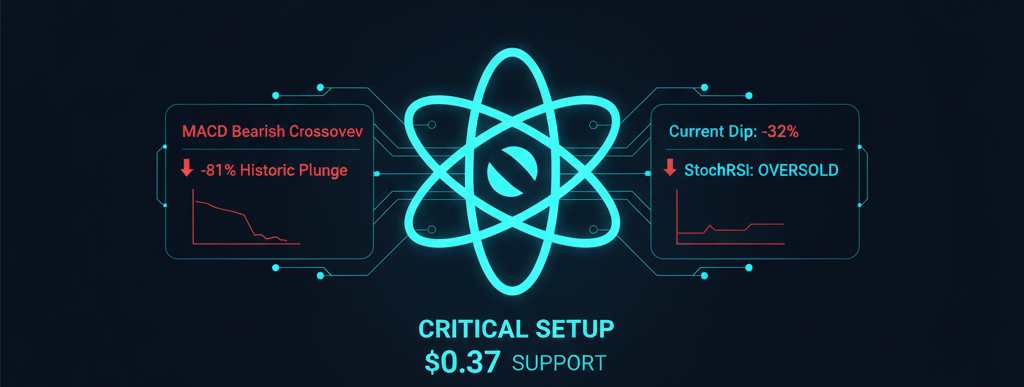

- The MACD indicator has crossed into bearish territory, a move that previously preceded an 81% plunge.

- The ADA token has already recorded a 32% retracement following Bitcoin’s drop to the $85,000 zone.

- StochRSI shows extreme oversold conditions, suggesting the asset might be undervalued.

Analysts are on high alert as Ali Martinez recently pointed out that the Cardano (ADA) price is repeating an extremely dangerous market structure. The primary reason is the Moving Average Convergence Divergence (MACD) crossing into the bearish zone—a signal that in the past triggered a massive 81% correction for the asset.

The last time the monthly MACD crossed bearish, Cardano $ADA dropped 81%.

— Ali Charts (@alicharts) December 21, 2025

The recent crossover has already led to a 32% decline. pic.twitter.com/qeqZi3qjPX

Currently, the asset has already experienced a 32% pullback, largely influenced by general market weakness and Bitcoin’s decline. However, other technical indicators reinforce the case for caution: the Exponential Moving Average (EMA) sits at $0.38, just below the current price, while the Bull Bear Power (BBP) remains in negative territory, confirming seller dominance.

Whales and On-chain Indicators: Between Distrust and Opportunity

Despite the grim scenario, not all data is negative for the Cardano (ADA) price. Although the Chaikin Money Flow (CMF) shows that whales are not yet convinced of an immediate rebound, there is a technical sign of hope. The Stochastic RSI (StochRSI) is in massive oversold levels, indicating that Cardano may be undervalued compared to its direct competitors.

The probability of a bounce for the bulls lies in the strength of the $0.37 support level and the success of Midnight (NIGHT), the ecosystem’s new token whose sidechain has recently generated significant optimism.

If whale buying appetite returns at this critical support level, the Cardano (ADA) price could invalidate the massive crash theory and begin a necessary accumulation phase for a future rally. For now, monitoring the $0.38 level is vital to determining the altcoin’s fate in the coming weeks.