Bitcoin moved back above $90,000 as broader risk sentiment improved ahead of the December FOMC meeting. Prediction markets are pricing in a 25-basis-point cut, and some traders are positioning for higher volatility in BTC. Bitcoin is often viewed by market participants as a proxy for global liquidity, although outcomes can change quickly and are not guaranteed.

Some market participants also look beyond large-cap assets for higher-risk, higher-volatility opportunities. However, returns are uncertain, and smaller tokens can carry additional risks, including limited liquidity and higher downside potential.

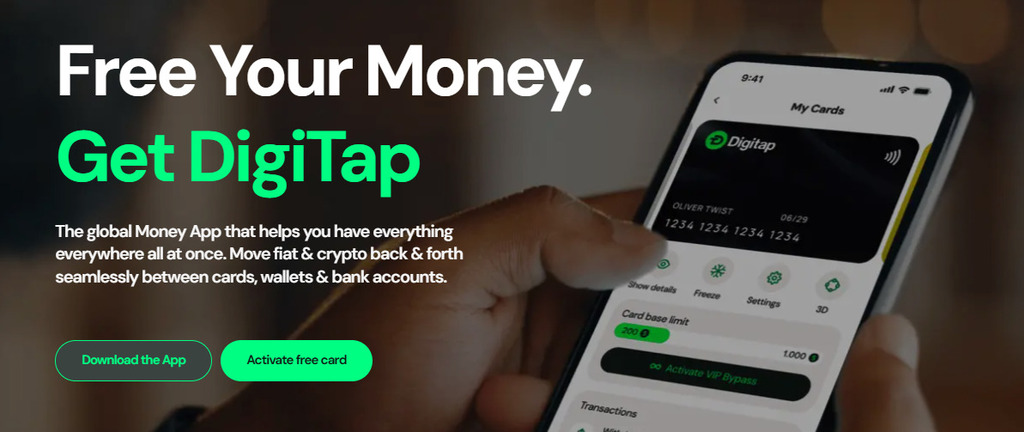

In that context, some traders have turned their attention to early-stage payments and banking-related crypto projects. Digitap ($TAP) is one project positioning itself around payments and a multi-rail “global money” app, according to its own materials, alongside a fundraising token sale.

Below is an overview of the market backdrop and what the project says it is building.

Bitcoin Breaks Above $90K as Risk-On Returns

Bitcoin’s move back through $90,000 comes as investors assess the outlook for rates and liquidity. Some analysts expect easier financial conditions in 2026, but the path of inflation, growth, and Federal Reserve policy remains uncertain. Any comparison between BTC and other asset classes can also shift quickly depending on market conditions.

On-chain and market data are often interpreted as signs of changing holder behavior, but these signals are not definitive. Flows into spot Bitcoin ETFs have also been a factor that some market participants watch, though ETF demand can fluctuate.

If the market moves into a higher-liquidity environment, some investors may rotate into smaller tokens. That approach can increase both potential upside and potential losses, and it may not be suitable for all participants.

Digitap and Its “Omni-Banking” Pitch

Digitap is one project describing itself as an “omni-bank,” combining traditional payment rails with crypto functionality. The project says it has raised more than $2.3 million and that the $TAP token is being offered via an ongoing token sale. Fundraising figures and token pricing are based on project-provided information and may not be independently verified.

While early fundraising can indicate interest, it does not confirm long-term adoption, product-market fit, or future token performance.

The project says its core product is a mobile app available on iOS and Android. Within one interface, it claims users can hold multiple fiat currencies and a range of crypto assets across different networks.

Digitap also states that it issues virtual and physical Visa cards that can be used with Apple Pay and Google Pay, and that it offers different onboarding options depending on the product. Availability, compliance requirements, and features can vary by jurisdiction.

The team also says that users can move funds and spend via card functionality, though usage experience and costs may depend on location, counterparties, and network conditions.

Inside Digitap’s Omni-Bank: Product Claims and Market Context

According to the project, Digitap’s app uses a multi-rail settlement approach and account abstraction features to support transfers via public blockchains and traditional rails such as SWIFT, SEPA, ACH, and Faster Payments. The project says users can initiate transfers without needing to manage the underlying technical complexity.

Digitap positions the product for use cases such as freelancer payouts and cross-border transfers. The project states that it can reduce fees and settlement times compared with certain traditional alternatives, but costs and speed can vary widely based on corridor, provider, compliance checks, and network congestion.

Cross-border payments and business payouts are large markets, and a number of fintech and crypto-native firms compete in these areas. Whether Digitap can scale in this segment will depend on factors such as regulatory coverage, banking partnerships, user growth, and unit economics.

Regarding the $TAP token, project materials describe utility elements such as cashback tiers, staking rewards, and token supply mechanisms (including token burns). Any rewards, eligibility, and parameters may change over time and are subject to risk, including smart-contract, counterparty, and regulatory risk.

BTC vs. $TAP: Large-Cap Asset vs. Early-Stage Token

Bitcoin is a large, liquid asset with established market infrastructure, including spot ETFs in some jurisdictions. By contrast, $TAP is presented as an early-stage token tied to a specific product ecosystem, and it may carry materially different risks related to execution, liquidity, and regulatory considerations.

Stablecoin growth and adoption are frequently cited as potential drivers for payments-focused applications, but projections about future supply and usage are uncertain. The competitive landscape for stablecoin-based payment products also includes both crypto-native and traditional fintech providers.

Digitap’s materials frame the app as a way to bring multiple rails and stablecoins into a single account experience. Readers should evaluate such claims carefully and consider product availability, compliance requirements, fees, and security before engaging with any financial application or token.

Project links (for reference):

Website: https://digitap.app

Social: https://linktr.ee/digitap.app

This article is for informational purposes only and does not constitute financial or investment advice. This outlet is not affiliated with the project mentioned.