TL;DR

- Bitwise Investment identifies two technical signals that could push Bitcoin into a new downtrend.

- The first is a critical support level around $27,000 showing recent weakness.

- The second is a declining trend in institutional buying volume. Analysts suggest that if both levels break, BTC could face additional short-term pressure, although long-term adoption and market activity continue to show resilience.

Bitcoin faces pressure as Bitwise analysts point to two key indicators that could influence its path. After volatile movements in recent weeks, BTC shows signs of consolidation that could signal a decline if the critical support does not hold. Market participants are increasingly analyzing macro factors, including rising interest rates and global liquidity trends, which could impact crypto sentiment. Technical traders are also closely watching historical patterns of BTC price reactions near $27,000, as these have previously preceded short-term corrections.

Bitcoin Faces Critical Support Levels

Bitwise highlights $27,000 as a key support level. In recent days, BTC has tested this level multiple times without sustaining a rebound. The lack of significant buying near this point suggests demand may not be strong enough to hold the price in the short term. Traders are closely watching whether this support can withstand another drop, as a break could open the door to $25,000. Analysts also note that short-term technical indicators, like RSI and moving averages, are showing mixed signals, which adds complexity to near-term predictions.

Institutional Volume Shows Signs of Fatigue

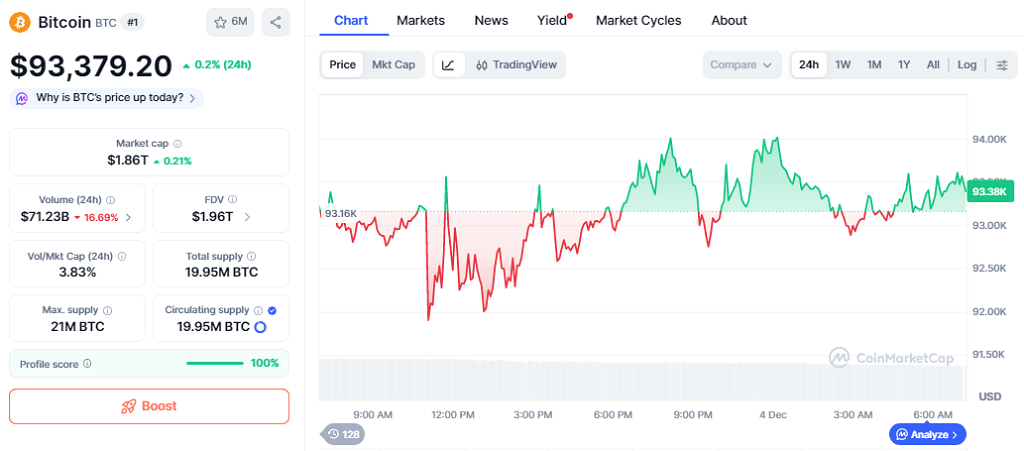

Another factor noted by Bitwise is the decline in institutional buying volume. Large investors who drove recent price gains are showing less interest in accumulating BTC at current levels. On-chain data shows net BTC inflows to institutional wallets decreased by 18% compared with last month. This trend could limit a quick price recovery and favor sideways or downward movements. Some traders also point out that exchange reserves are rising slightly, suggesting that investors may be preparing to sell if BTC falls below key levels. The current BTC price stands at $93,379 (+0.2%).

Market Implications and Projections

Despite these technical signals, analysts maintain a pro-crypto perspective. BTC adoption continues to grow, with daily transactions exceeding 350,000 BTC and consistent interest in derivatives and investment funds. This indicates that while the short term may face corrections, the overall market structure still offers opportunities for long-term investors.

Experts recommend monitoring the $27,000 support and institutional volume closely to anticipate potential trend changes. Analysts also suggest paying attention to BTC correlations with traditional markets in the coming weeks, as shifts in equities or bonds could amplify short-term volatility.