TL;DR

- Bitcoin started December under pressure, posting significant losses alongside altcoins, affected by macroeconomic factors and rising risk aversion.

- Bloomberg Intelligence warns that BTC could fall to $50,000 and that the BTC/Gold ratio could adjust from 20x to 13x due to low S&P 500 volatility.

- McGlone compares the situation to the 2018 crash and cautions that continued pressure on risk assets could push Bitcoin close to $10,000 if the correction deepens.

The cryptocurrency market began December with sharp declines. Bitcoin (BTC) and major altcoins recorded significant losses over the past 24 hours, driven by macroeconomic factors and growing risk aversion.

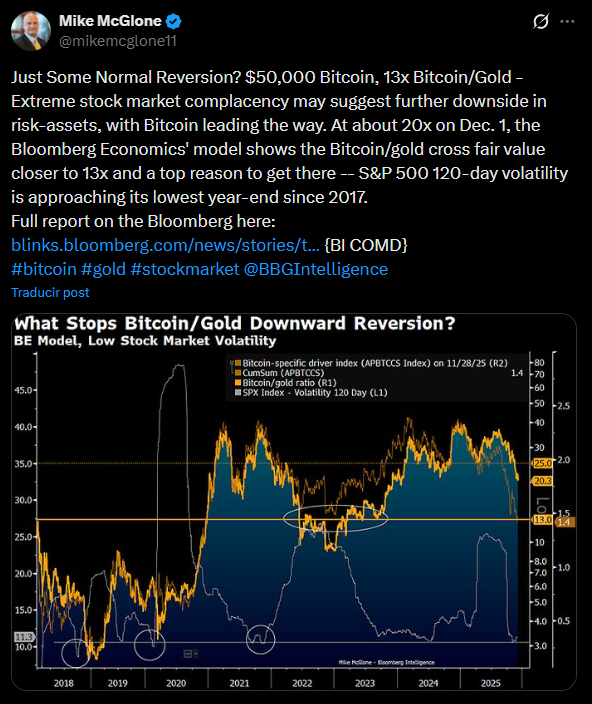

Mike McGlone, a strategist at Bloomberg Intelligence, noted that Bitcoin may face additional corrective pressure in the medium term. According to his analysis, BTC could retest the $50,000 level, while the BTC/Gold ratio, currently at 20x, could adjust toward 13x. This decline would reflect a market alignment with the cryptocurrency’s fair value relative to gold.

The main variable driving this scenario is the S&P 500’s 120-day volatility, approaching its lowest year-end level since 2017. McGlone warned that low equity market volatility tends to increase correction risk in risk assets, with Bitcoin likely to be the first affected.

The strategist recalled that toward the end of November, the market showed signs of structural weakness. He compared the current situation to the 2018 crash, suggesting that if pressure on risk assets continues, Bitcoin could even fall to levels near $10,000.

Is Bitcoin Overvalued?

The BTC-to-gold ratio serves as an overvaluation indicator. McGlone’s model shows that while the ratio currently reaches 20x, its “fair value” is around 13x. A correction would imply a significant adjustment in BTC’s price, driven by market sensitivity to macroeconomic conditions and risk perception.

Analysts agree that early December exposed cryptocurrencies’ vulnerability to low volatility in traditional markets. Bitcoin’s performance in the coming days could set the trend for the crypto market through the end of 2025, with potential rebounds or further declines depending on the reactions of institutional and retail investors.

McGlone’s forecast serves as a warning for traders and investment funds. The combination of these factors suggests that Bitcoin’s movements could be sharper than usual, making it crucial to anticipate substantial adjustments before year-end.

The market watches and waits. The signal is clear: if macroeconomic conditions remain unchanged, the correction could materialize, bringing BTC closer to critical support levels, including the $50,000 threshold