TL;DR

- Bitcoin fell 6%, pulling total market value toward $2.92 trillion.

- The Coinbase Premium Index turned negative, signaling weak U.S. demand.

- Analyst Peter Brandt warns of a potential deeper correction toward $70,000.

Bitcoin extended its pullback on December 1, with price slipping about 6% intraday to nearly $85,653. The drop dragged the broader crypto market capitalization down more than 5%, toward $2.92 trillion, and reinforced concern about waning appetite from large U.S. buyers.

Market screens showed pressure across major coins, yet Bitcoin remained the main driver. Traders continued to reduce risk after several failed pushes above the $95,000 area, where supply repeatedly absorbed fresh bids.

Coinbase Premium Index Turns Deeply Negative Again

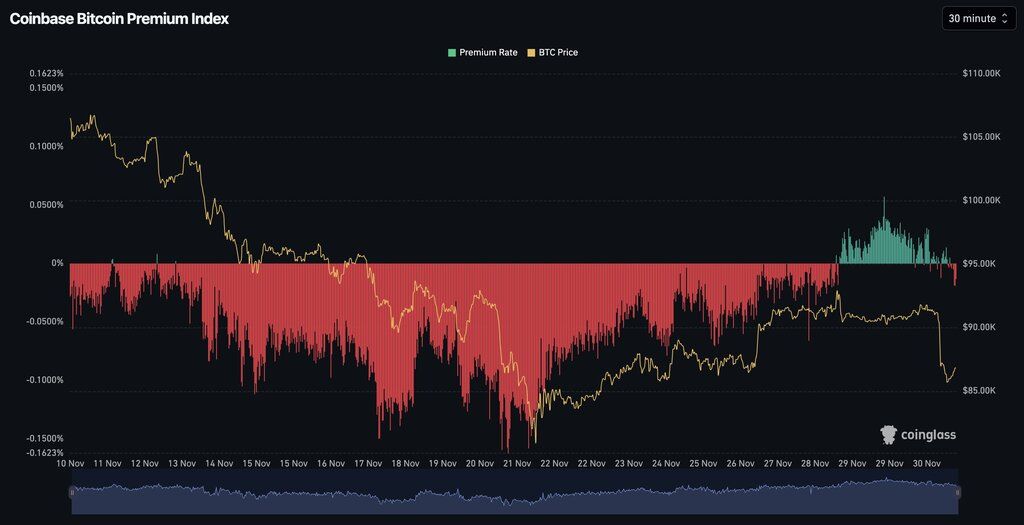

Fresh readings from the Coinbase Bitcoin Premium Index indicated renewed weakness on U.S. spot venues. The indicator tracks the price difference between BTC on Coinbase and prices on large offshore exchanges. A negative premium means Bitcoin changes hands at a lower level on Coinbase, which usually signals softer demand from U.S.-based investors and desks.

Charts shared on December 1 showed the premium sitting below zero for most of November. Only a short push near the $95,000 region sent the metric back above neutral before selling pressure returned. Extended stretches below zero in the past often lined up with periods of elevated supply or muted institutional inflows from U.S. platforms.

For traders who watch order books and basis closely, a negative premium acts as an early warning. Heavy hedging activity or reduced spot buying frequently appears around the same time, and both patterns fit the current tape.

Peter Brandt Warns About Deeper Correction Levels

Veteran trader Peter Brandt reiterated a bearish short-term view on December 1 in a chart post on X. He highlighted a long-term logarithmic chart and pointed to a broad support band that starts just below $70,000 and stretches into the mid-$40,000 zone.

According to his interpretation, Bitcoin still trades above the center of that region, which leaves room for further downside before a durable base forms. Brandt also argued that forced selling could accelerate any fresh leg lower. In his view, funds and listed companies that hold large BTC positions may face pressure to cut exposure if risk sentiment deteriorates further.

Not to bust anyone's banana, but the upper boundary of the lower green zone starts at sub $70s with lower boundary support in the mid $40s.

How soon before Saylor's Shipmates ask about the life-boats? $BTC pic.twitter.com/YLfjSDdw9H— Peter Brandt (@PeterLBrandt) December 1, 2025

Last month, his earlier support areas near $81,000 and $58,000 attracted attention after Bitcoin slipped below $100,000 and then $81,000 in quick succession. Many traders now monitor the lower band of his zone for signs of a potential flush toward the $40,000s if liquidation flows expand.

Long-Term Bitcoin Trend Still Viewed as Intact

Despite the caution over near-term price action, Brandt continues to describe Bitcoin as a long-term bullish asset. His comments stress that current trading represents a correction inside a broader multiyear uptrend, not the end of that pattern.

Long-only holders and many macro-focused investors still frame Bitcoin as a store-of-value asset that reacts to monetary policy and global liquidity rather than quarterly headlines. From that angle, deeper dips into support zones may attract fresh spot demand from buyers with longer horizons, even as shorter-term traders manage risk around premium signals, liquidations, and technical levels.