TL;DR

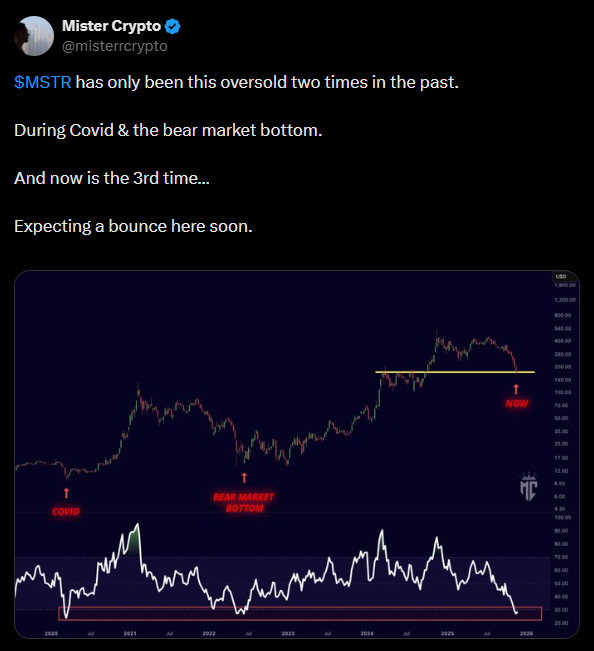

- Strategy (MSTR) shares have reached a rare oversold zone, similar to historical pivot points in 2020 and 2022, signaling weakness in momentum.

- Strategy is holding above a horizontal support at $184.15 with an RSI of 26.9 and accumulation flows of $160.73 million, indicating that the level is attracting activity.

- The stock could be starting a momentum shift, though the trajectory will depend on breaking descending highs and the strength of demand.

Strategy (MSTR) shares show technical signals that have caught the attention of chart analysts, who compare their current behavior with historical gold patterns before its parabolic peak in 1980.

What’s Happening with Strategy Shares?

Indicators suggest that MSTR has entered a rare oversold zone, the third in five years, previously coinciding with key pivot points in 2020 and 2022. This level indicates that selling pressure has pushed the asset’s momentum to one of its weakest points in recent years.

In recent sessions, MSTR has found support around $184.15, following a decline that started after the 2025 highs. The relative strength oscillator shows an RSI of 26.9, signaling weakness compared to its benchmark group, while the short-term RSI of 67 reflects that intraday buyers have regained control of the price. Hourly volume reached 878.92K, and the accumulation/distribution panel shows aggregate flows of $160.73 million, highlighting that the support level is attracting significant activity.

Comparative charts show that the stock’s structure resembles gold in 1980: after strong rallies, both assets experienced lower-high rejections followed by extended selling periods. The comparison does not imply identical causes, but rather momentum exhaustion cycles that produce pronounced directional phases. In MSTR, the decline has been faster, reflecting the volatility of the equity market and its exposure to macro and crypto industry factors, whereas in gold the sequence was more prolonged.

MSTR Could Spike or Deepen Its Correction

The recent 1.4% rebound suggests MSTR might be starting a momentum shift. Analysts note that breaking descending highs and trend compression often precede significant directional moves. However, they warn that the trajectory could be bullish or bearish, depending on demand strength and resistance at key levels.

MSTR is at a critical technical juncture. The combination of horizontal support, oversold indicators, and historical comparisons to macro assets like gold suggests that the coming days will define the stock’s direction. Shares could experience a controlled rebound or a deeper pullback if selling pressure persists