TL;DR

- A record $13.74 billion in BTC options are set to expire on November 28th.

- Traders show a split outlook, targeting $100k+ but hedging against a dip.

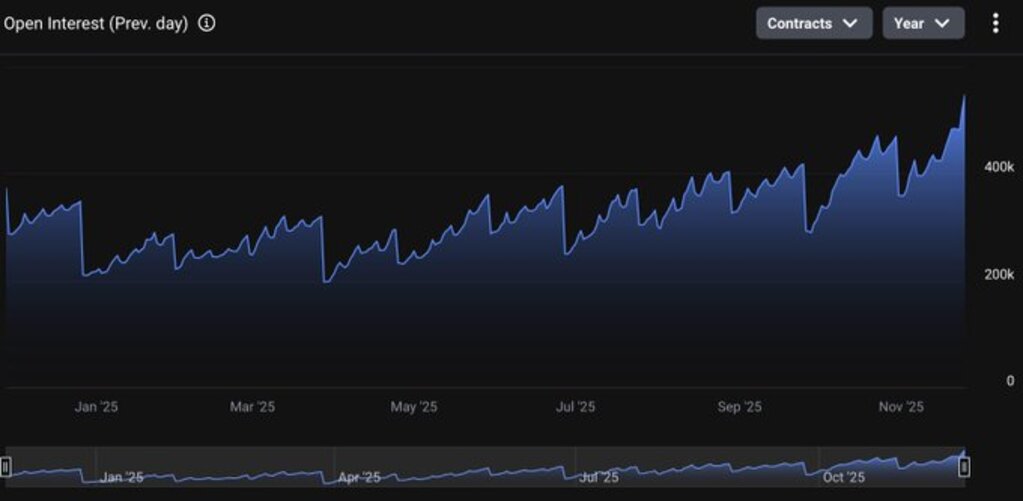

- Open interest hits a record $43 billion as volatility sharply increases.

Deribit reports an intense buildup in BTC options and ETH options, with expiries scheduled for November 28. The exchange expects 13.74B dollars in BTC options and 1.74B dollars in ETH options to reach expiration. Market activity grows rapidly, and traders react to higher volatility with aggressive positioning across multiple strikes.

Open interest rises above 43B dollars, marking a record in total contracts for the exchange. BTC options traders display optimism for price levels above 100,000 dollars, while maintaining caution for a possible dip toward 85,000 dollars. Year-end sentiment also begins to form within options positioning, with market participants hedging against sharp moves in both directions.

Deribit reports surging interest as BTC shows wider price swings. Traders create new hedges and expand exposure during the downturn into the 80,000-dollar range. Early recovery signs encourage fresh contracts, lifting open interest heavily during the past week.

Deribit just recorded its highest BTC options OI in contract terms (~560K) pic.twitter.com/ZC5G5onONO

— Deribit (@DeribitOfficial) November 26, 2025

Daily trading volume climbs to 1.5B dollars, with 1.3B dollars concentrated in BTC options. The rise reflects the return of volatility to levels not seen in half a year. Traders rely on options for protection, avoiding liquidation risks tied to perpetual futures, which often unravel during fast price movements.

BTC Heads Into Massive Options Expiry With High Volatility

A total of 13.74B dollars in monthly BTC options approaches expiry on November 28, down from 17B dollars in October. The maximum pain level sits at 100,000 dollars, and price action remains below that mark. Expiry events often lead to weekend volatility, creating room for tighter ranges once contracts roll off.

Around 22% of contracts sit at the money, while 77% remain in the money. Traders continue to protect against downside risk and, at the same time, position for an upside extension above 100K dollars. Contracts accumulate within the 102,000–105,000 range, forming a split outlook between bullish conviction and caution toward deeper retracement.