TL;DR

- Monad dropped nearly 10% in 24 hours following its airdrop, with its current price around $0.04, influenced by multiple factors.

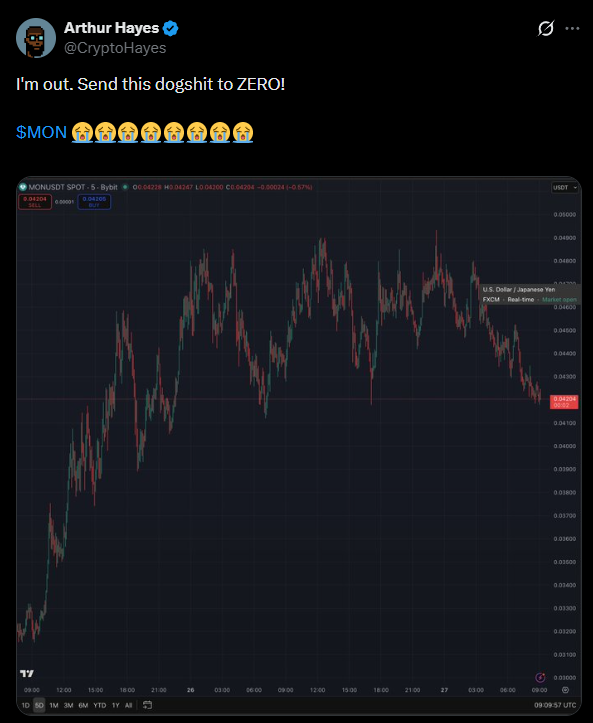

- Arthur Hayes turned bearish and warned of a potential collapse.

- The relationship with market makers like Wintermute and the concentration in derivatives increase liquidity risk and volatility in an already weakened altcoin market.

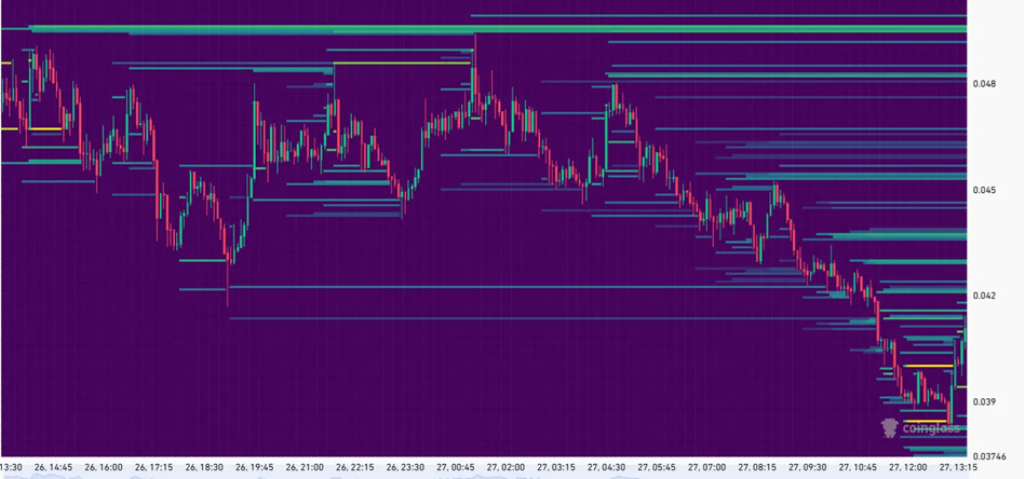

Monad is experiencing its first week of turbulence after the airdrop of its MON token, which fell close to 10% in the last 24 hours, reaching $0.04 after peaking at $0.047.

Part of the correction can be attributed to Arthur Hayes, BitMEX founder, who openly declared a bearish stance and warned of a potential total collapse of the token. The price drop liquidated small long positions, while short positions have accumulated up to $0.05, reflecting significant selling pressure and a fragmented market between buyers and sellers.

The Pullback Could Set the Stage for a Balance Point

MON trading maintains high open interest, with over $65 million concentrated on Binance. Coinbase and Bybit lead the spot market, accounting for more than 37% of MON’s total volume, while Binance captures over 89% of derivative trading. Liquidity is mainly concentrated in perpetual contracts, and the accumulation of short positions suggests the pullback could act as a balance point before a potential rebound.

Part of the volatility is linked to the project’s relationship with market makers, particularly Wintermute. This firm received a one-year loan of unlocked MON tokens, while other market makers only have a month’s supply. The concern is that these actors may sell large amounts of Monad in the short term and then buy back at lower prices, potentially causing liquidity errors and increased downward pressure. This dynamic highlights the concentration of power and the structural risk of a low-float, VC-backed token.

Monad (MON) Is Vulnerable to Rapid Corrections

Monad also faces adoption and perception challenges in the altcoin market. Its Solana version counts nearly 12,000 holders, but top whales have sold a large portion of their tokens, earning limited profits of up to $85,000. Activity on Hyperliquid placed Monad (MON) among the 10 most active tokens alongside ASTER and PUMP, but volatility and selling pressure threaten to hinder the project’s consolidation.

The overall context for Monad is high risk. Its price remains in a discovery phase, and the weakened altcoin market only amplifies uncertainty. The combination of aggressive selling, loans to market makers, and a highly concentrated derivatives market makes the token susceptible to rapid corrections. The coming days will be crucial to determine whether Monad stabilizes or continues its decline