TL;DR

- AMINA Bank AG and Crypto Finance Group demonstrated in a GCUL pilot that Swiss institutions can settle fiat payments nearly in real time and on a 24/7 basis.

- The test confirmed that programmable commercial money enables large-scale transfers while reducing operational friction and funding costs.

- Crypto Finance acted as the Currency Operator.

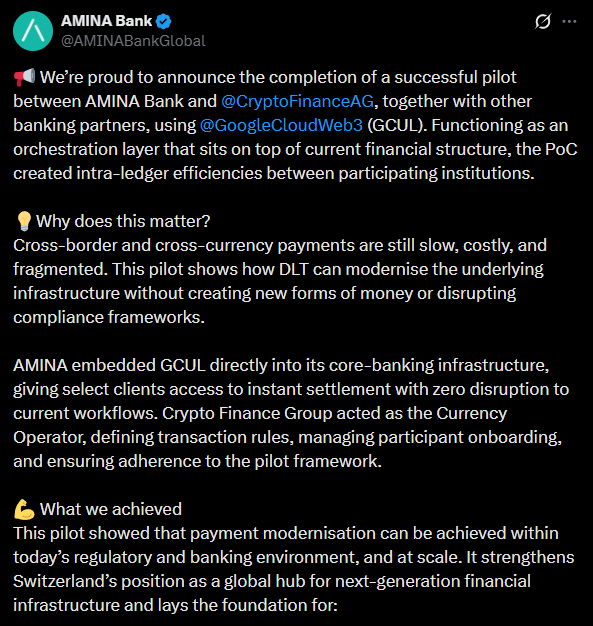

AMINA Bank AG and Crypto Finance Group completed a pilot with several Swiss banks to show how DLT can modernize traditional financial infrastructure.

The pilot was conducted on Universal Ledger (GCUL), Google Cloud’s platform for distributed-ledger-based settlement. The test delivered near-real-time, 24/7 settlement of fiat payments between Swiss-regulated institutions, with transactions flowing without friction. Everything was executed under the same compliance, security, and governance standards used in traditional commercial banking, enabling faster processing without issuing new digital currencies or altering existing supervisory models.

The bank argues that embedding DLT beneath current banking infrastructure accelerates processes without altering regulatory stability, preserving the framework already validated by supervisors. This opens a modernization path that avoids disruptive changes to monetary issuance or regulatory structures.

AMINA Showcases the Next Level of Traditional Banking

Switzerland is emerging as a leader in next-generation payment infrastructure. The pilot shows that programmable commercial bank money (in its wholesale form) can operate on GCUL to support large-scale account-to-account transfers. For participating institutions, this creates an opportunity to reduce operational friction, lower funding costs, and enable more modern services for retail, corporate, and institutional clients.

AMINA Bank CEO Franz Bergmueller describes GCUL as proof that innovation and stability can coexist. He says the pilot enables near-instant, fully compliant settlement and that AMINA is ready to scale this model globally. Crypto Finance Group CEO Stijn Vander Straeten adds that the initiative marks an inflection point for digital financial markets, where a designated currency operator can become the foundation for digital payments and tokenized assets.

Within the pilot’s operational architecture, Crypto Finance acted as the Currency Operator, handled participant onboarding, and ensured compliance with transaction rules. Institutions executed payments directly on GCUL while keeping their regulatory obligations intact. AMINA Bank and other institutions integrated GCUL at the core-banking level.

Google Cloud highlights that the pilot demonstrates how cloud-native financial infrastructure can deliver near-instant, secure, and regulation-compliant payments. With the test completed, the next phase focuses on scaling the platform, onboarding additional institutions, and moving toward live operations beyond controlled testing environments.