TL;DR

- XRP open interest falls to its lowest in one year.

- Most trading liquidity has now moved to Binance.

- Negative funding rates signal potential further price declines.

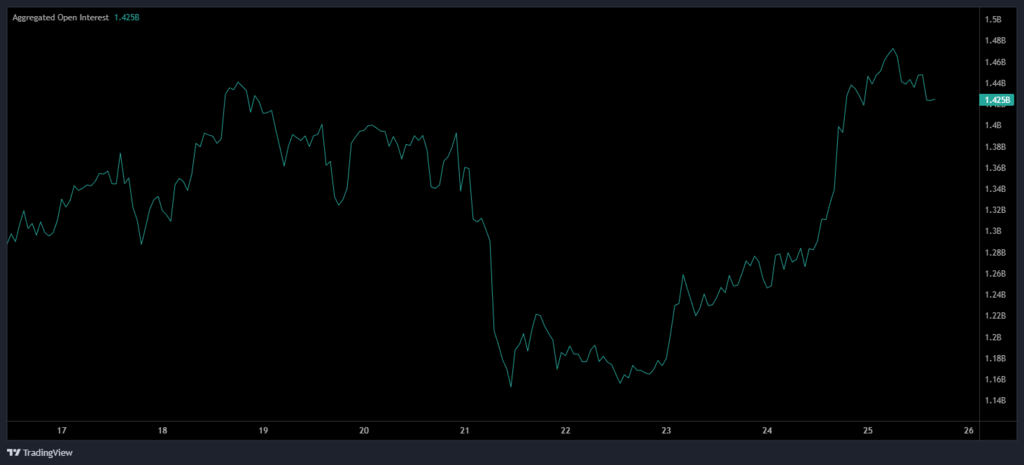

XRP trading loses momentum as open interest falls to a one-year low. The token struggles to find a clear direction, leaving derivative traders on hold for a strong signal.

During the recent drop below $2, XRP lost most of its open interest. The token briefly bounced to around $2.21, recovering from local lows, but trading volumes have diminished over the past months.

XRP Liquidity shifts to Binance

Most liquidity for XRP moved to Binance, which now handles over 7% of its trading. On the exchange, open positions fell from $1.7B to $591M, hitting a recent low of $473M. Both long and short positions declined as traders avoided the choppy market. The lack of directional conviction prevents sustained momentum for derivative activity.

The largest decline in open interest occurred when XRP dropped below $2, and rebuilding positions may take longer. Lower prices combined with low open interest indicate that traders are waiting for clearer signals, while short-term activity fails to support a price recovery.

Indicators point to potential downside

XRP funding rates have often turned negative on certain exchanges, signaling selling pressure and potential further declines. Social media sentiment among retail traders remains mostly bearish, reflecting the aftermath of whale distribution without renewed accumulation by large holders.

XRP’s ETF prospects in 2025 were delayed, with Solana taking the lead in new products. Ripple announced plans for a $1B treasury, although it already holds large reserves of tokens. The XRPL layer liquidity remains limited, capturing only a small share of DeFi activity.

Despite a 21% rise in social media mindshare over recent weeks, XRP remains predominantly bearish until new liquidity sources emerge. Derivative traders continue to monitor the market, awaiting a clear directional signal to reenter positions.