TL;DR

- Bitcoin saw one of its largest ever supply shifts.

- A key analyst calls this a historic on-chain event.

- The Federal Reserve’s next decision holds the market key.

Bitcoin (BTC) recorded one of the largest supply movements in its history, with more than 8% of the total cryptocurrency changing hands in the past week. Investors brace for the U.S. Federal Reserve (Fed) interest rate decision in December and adjust expectations toward a potential rate cut.

During the recent market downturn, a historic shift in Bitcoin ownership occurred, while the broader crypto market remains uncertain about U.S. monetary policy.

Joe Burnett, analyst and Director of Bitcoin Strategy at Semler Scientific, called the week “one of the most important on-chain events in Bitcoin’s history.” Burnett noted that previous significant supply movements happened in March 2020, when Bitcoin traded near $5,000, and December 2018, around $3,500. Both periods preceded accumulation phases that led to new all-time highs.

A little less than half of this movement can be attributed to @coinbase.https://t.co/1WjwwH2cQk

— Joe Burnett, MSBA (@IIICapital) November 24, 2025

However, Burnett highlighted that up to half of the current supply movement may be linked to a Coinbase wallet migration announced on Saturday, which moderates the event’s overall magnitude.

Bitcoin on a Knife’s Edge

Bitcoin’s price and investor sentiment remain in a delicate state, according to Nic Puckrin, digital asset analyst and co-founder of The Coin Bureau. He points out that the Fed’s decision will determine whether the market experiences a holiday rally or a drop.

“What is certain is that the Fed holds the key to the market’s year-end outcome. Its next rate decision will decide if we see a Santa rally or a Santa dump,” Puckrin told. He added that, as December 10 approaches, market jitters will continue, and the Fed’s press conference will keep traders on edge.

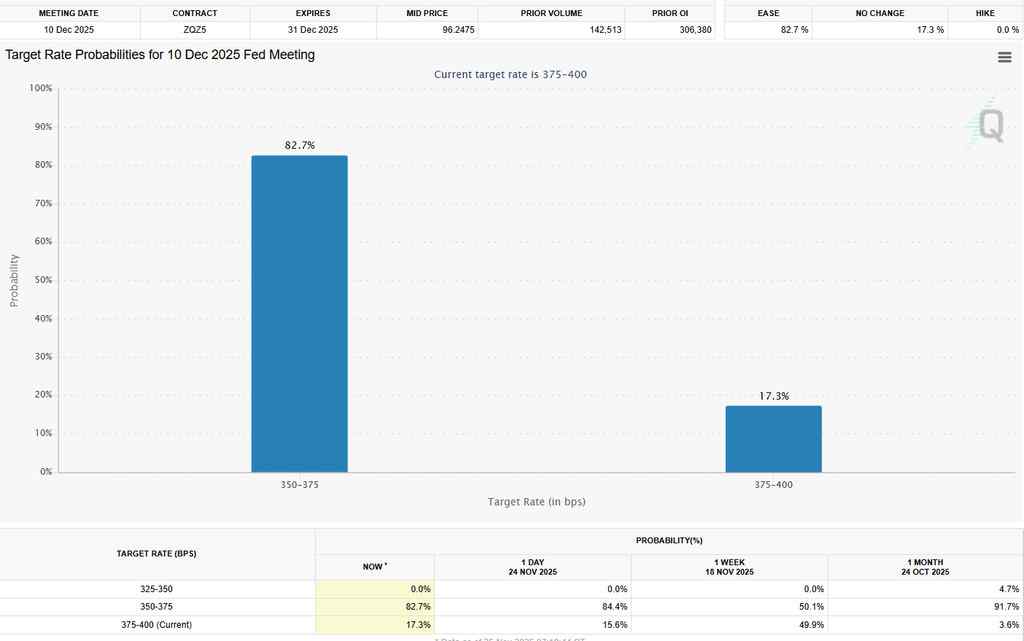

Currently, markets price in an 82% chance of a 25 basis point rate cut, according to the CME Group’s FedWatch tool, up from 50% the previous week.

Bitcoin stands at a critical moment, with high supply turnover and a macroeconomic context that could define market direction in the coming weeks.