TL;DR

- Bitcoin stabilizes near key resistance after a volatile drop.

- The asset trades near multi-month lows throughout November.

- One projection suggests Bitcoin could revisit the $80,000 level.

Bitcoin advances its recovery on Monday and moves near a key resistance for a second straight day. BTC handles complex price zones throughout November, loses the 100,000-dollar psychological mark, and trades near multi-month lows amid intense volatility.

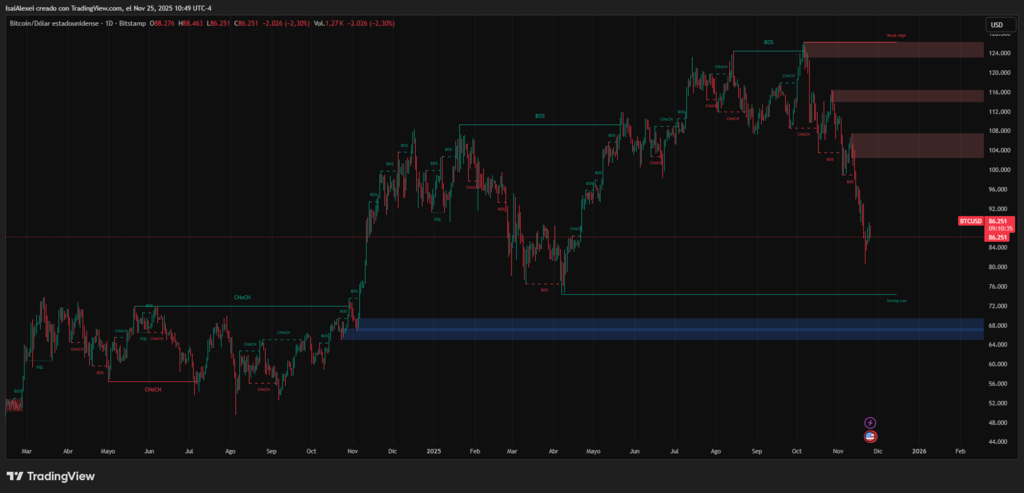

Last week, BTC fell below 90,000 dollars for the first time since April and reached 80,600 dollars on Friday. Over the weekend, price action stabilized between 84,000 and 87,000 dollars, with a brief attempt to break 88,000 dollars before rejection.

Arthur Hayes, co-founder of BitMEX, claims Bitcoin may gain support from “minor improvements” in US liquidity trends. In a Monday post, he notes that price movement stays under 90,000 dollars in the coming weeks and, in one projection, even revisits 80,000 dollars, although it maintains structure.

Meanwhile, Rekt Capital argues that Bitcoin returns to a re-accumulation region between 82,500 and 93,000 dollars, an area where price consolidated in Q1 2025 after losing the upper boundary as support.

The analyst states that the base formed inside that band fueled an earlier cycle rebound and continues to define the lower limit of the current structure. Both ranges form a clear monthly band between 82,500 and 93,000 dollars, useful for tracking the consolidation phase.

Technical Analysis of Bitcoin (BTC) – November 25, 2025

The current price of Bitcoin (BTC) as of November 25, 2025, stands at approximately $87,061 USD, marking a +1.06% increase in the last 24 hours, with a daily range between $86,674 and $88,457. The market capitalization has reached $1.73 trillion, solidifying BTC’s dominance in the cryptocurrency market, with a 24-hour trading volume exceeding $69 billion.

From a technical perspective, BTC is currently consolidating after facing rejection near the $88,500 resistance level, which aligns with the upper boundary of the ascending channel that has been in play since mid-September.

Immediate support lies around $85,800, and a bearish break below this level could push the price toward $82,000, where both the 50-day moving average and a key psychological support converge. Conversely, a clear breakout above $89,000 could pave the way toward $92,500, signaling a new bullish phase before year-end.

The RSI (Relative Strength Index) remains near 30 points, indicating moderate bullish momentum, while the MACD continues to display a positive divergence, reinforcing the likelihood of an ongoing uptrend. However, the recent drop in trading volume suggests the market might experience a short-term correction before attempting another upward push.

Regarding recent news, Bitcoin has benefited from growing optimism around institutional adoption and the launch of new spot Bitcoin ETFs, which have encouraged greater institutional inflows.

Additionally, the stabilization of the U.S. Consumer Price Index (CPI) has lowered expectations for further Federal Reserve rate hikes, boosting investor appetite for risk assets like BTC. Large wallets (whales) have also been reported accumulating Bitcoin around current levels, reflecting confidence in medium-term price appreciation.