Tl;DR

- Crypto markets lost one trillion dollars last month.

- Analysts identify a bullish structure beneath the panic.

- Some compare current conditions to 2019’s market.

Crypto markets shed nearly one trillion dollars over the past month after a retail sell-off triggered by panic. Traders cut exposure at high speed, and several analysts defend a bullish structure supported by liquidity flows and recent macro signals.

Analyst Sykodelic states that crypto climbs a “wall of worry” of unmatched size. The analyst compares current conditions with 2019 and argues that markets do not enter a prolonged contraction. The view relies on a macro environment that does not promote an extended bearish cycle.

It's coming together here.

The bear market doom callers are going to be sweating pretty soon.

Over the next month we are going to climb the biggest wall of worry that has ever existed in Crypto.

For anyone that has been following, It should be clear by now that we are in a… pic.twitter.com/1IW8c0ggTQ

— Sykodelic 🔪 (@Sykodelic_) November 24, 2025

Michaël van de Poppe, founder of MN Fund, recalls patterns observed during the early pandemic crash. He notes how Bitcoin loses more than 50% in March 2020, then closes the year with a new all-time high. He adds that many traders wait for fresh lows, yet recent episodes show quick reversals when price gains strength during consecutive weeks.

This recent crash on the markets reminds me a lot of the COVID crash on #Bitcoin.

Yes, it was heavy.

People expected to see another test at the lows, actually, during these times, lower lows were also expected in the COVID crash.

It never happened.

The higher price went,…

— Michaël van de Poppe (@CryptoMichNL) November 24, 2025

Altcoin Alf presents another angle

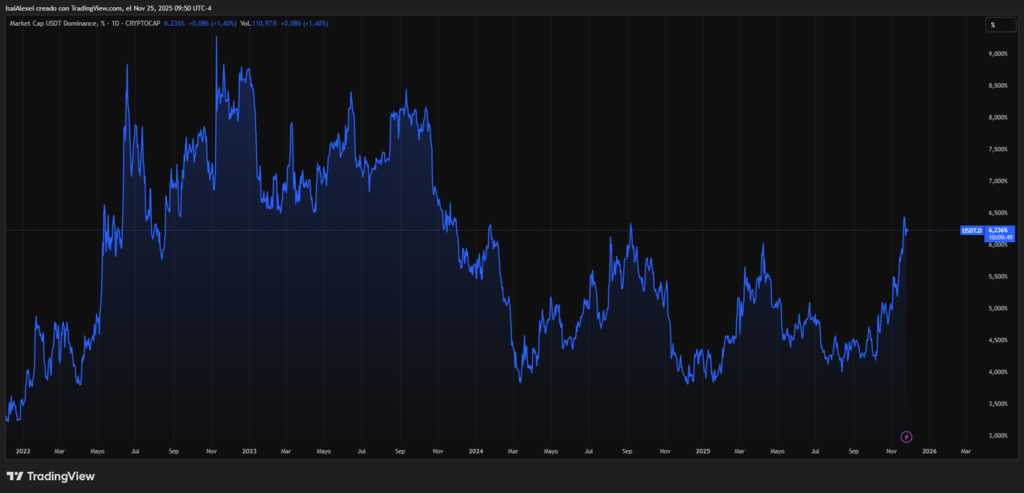

He tracks USDT dominance (USDT.D) and highlights weekly stochastic cross-downs that often precede broad crypto rallies. Every signal in the past 28 months aligns with a market push. He believes BTC approaches fresh highs, and altcoins outperform once capital rotates. He also points to equal lows that attract liquidity hunts during aggressive moves.

Crypto commentator Colin Talks Crypto adopts a more cautious tone. He notes bearish signals, but still expects one final upward leg before momentum cools.

Crypto markets operate under heavy pressure, yet analysts keep reinforcing a constructive structure as long as liquidity supports buying activity. Market participants track each technical trigger and monitor capital rotation to find opportunities inside a deep correction.