TL;DR

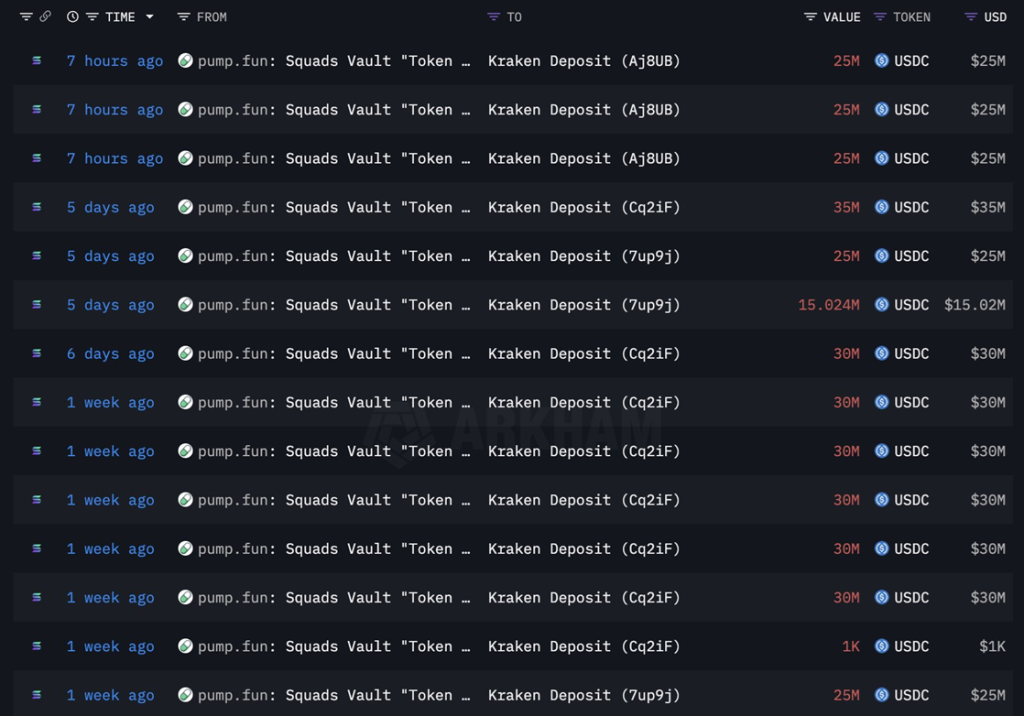

- Pump.fun states that the $435.6M in USDC transfers to Kraken-linked addresses were part of an internal treasury reorganization.

- The team adopted a strategy that retains a larger portion of SOL and allocates another portion to PUMP buybacks to support its price.

- The platform launches 15,000 new tokens per day and generates more than $1.4M in fees.

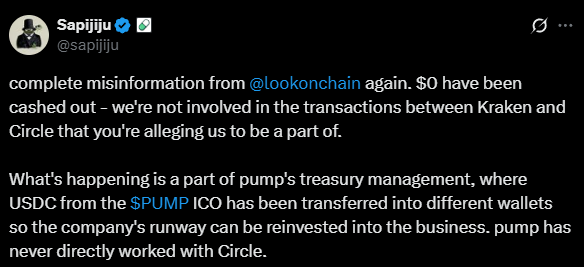

Pump.fun maintains that it did not cash out USDC on Kraken and argues that the on-chain movements are part of an internal treasury reorganization tied to revenue from its ICO.

Internal Reorganization and New Investments

The meme token launch platform says it did not sell funds on the market, and that the transferred capital was redistributed across its own wallets to structure new investments and maintain a stable relationship between capital availability and operational strategy. Pump.fun clarified the situation after analysts flagged $435.6M in USDC transfers to addresses associated with Kraken, which led to speculation that the company was preparing a large-scale exit.

The project had already been closely monitored due to previous SOL movements over the past year. Those historical sales raised doubts about treasury management, but the team says it adopted a different approach in recent weeks, retaining a larger portion of SOL and allocating another portion to PUMP buybacks on the open market.

This policy seeks to support the token’s price and soften the negative impact of the recent market downturn. Despite the effort, the token dropped to $0.0026, its lowest level in 2025, and sits 72% below the local high recorded in September. The decline also affected the project’s presence in the market, with a drop of more than 44% in social visibility and online discussion levels around the token.

Pump.fun Fails to Regain Momentum With Mayhem Mode

Pump.fun continues to maintain a high level of activity within the Solana ecosystem, creating roughly fifteen thousand new tokens per day through its platform. This dynamic places it among the top ten applications in daily fee generation, with more than $1.4M in revenue.

Even so, activity has slowed since the last memecoin wave in September, and the introduction of AI-driven trading in Mayhem Mode did not accelerate volumes. Only 85 projects per day achieve the minimum volume required to “graduate” and reach a significant market capitalization, and most fall far short of the $30M levels some were reaching months ago.

Pump.fun is expanding its operational structure with new acquisitions, including the Padre Trading platform and tracking tool Kolscan, and is allocating nearly all of its daily revenue to buybacks of its native token.