TL;DR

- AVAX One executed a $110 million purchase in AVAX, raising its total position to 13.8 million tokens within the Avalanche network.

- The company has turned its treasury into a vehicle designed to capture structural value from the AVAX ecosystem.

- The firm retains more than $35 million in cash to continue buying AVAX or repurchasing its own shares.

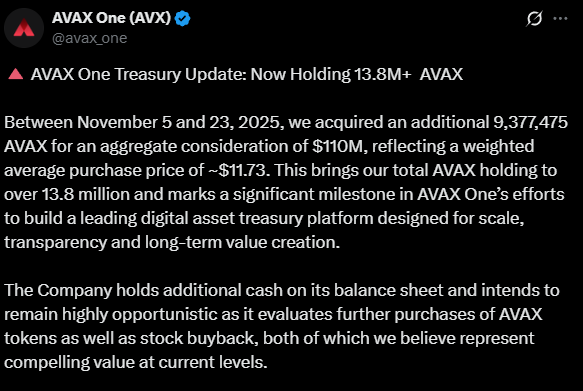

AVAX One is carrying out an aggressive expansion strategy in Avalanche with a $110 million AVAX purchase, taking its total position beyond 13.8 million tokens.

The company moves forward after its rebranding and transforms its treasury into a vehicle aimed at capturing structural value within the Avalanche ecosystem. The accumulation takes place during a period of market weakness, and the company’s leadership argues that current volatility offers suitable prices to reinforce its long-term institutional position.

AVAX Has $35 Million to Continue Strengthening Its Treasury

The company purchased 9,377,475 AVAX between November 5 and November 23, 2025, at an average price of $11.73 per token. This operation positions the firm as one of the largest institutional holders of the token. The treasury also holds more than $35 million in cash available for additional Avalanche token purchases or share buybacks. The goal is to increase AVAX per share and create a direct link between Avalanche ecosystem growth and shareholder value.

The board has an authorized share buyback program of up to $40 million, set to begin in the coming weeks. The company is also evaluating additional capital formation avenues to scale its acquisitions, strengthen its balance sheet, and establish itself as a central player in the on-chain financial economy developing on Avalanche.

Why Avalanche?

According to the management team, this policy is based on the belief that Avalanche brings the right technical characteristics for large-scale institutional financial applications. They highlight that the network offers infrastructure built for high-volume operations in decentralized finance, enterprise applications, and real-world asset initiatives. Management believes these segments generate activity flows that increase demand and reinforce the token’s value as a strategic treasury asset.

The price of AVAX trades around $13.30 and remains dependent on the pace of institutional adoption, ecosystem liquidity, and overall crypto market conditions in the coming months.