TL;DR

- Grayscale begins trading its spot XRP and Dogecoin ETFs today on the New York Stock Exchange after SEC approval issued on November 21.

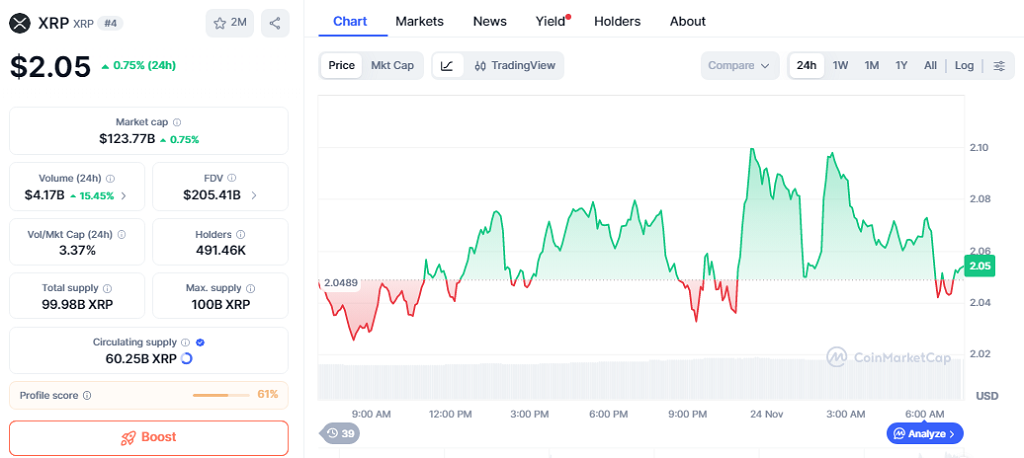

- Dogecoin gains 1.24% in the past 24 hours as institutional investors position ahead of the launch, while XRP holds a $123.77 billions market cap with moderate growth.

- Bloomberg analysts estimate up to $11 million in first-day trading for the DOGE ETF, signaling growing demand for regulated altcoin exposure.

Dogecoin and XRP open today with strong institutional attention as Grayscale’s new ETFs start trading on the New York Stock Exchange.

Both assets show measured price action before trading begins. Dogecoin trades at $0.1450, up 1.24%, with a market cap of $22.03 billions. XRP trades at $2.05, gaining 0.75%, and holds a market cap of $123.77 billions. Analysts suggest that the listings may attract sidelined capital from investors who previously avoided direct token exposure due to custody issues or regulatory uncertainty.

XRP And Dogecoin ETFs Drive Institutional Demand

The regulatory approval was confirmed in separate SEC releases on November 21. This decision allows Grayscale to launch two exchange-traded funds that mirror the value of the underlying tokens, offering exposure without requiring investors to manage the assets directly. The structure appeals to traditional fund managers seeking compliant access to crypto markets, particularly those expanding into thematic and digital asset strategies.

Bloomberg ETF analyst Eric Balchunas stated that Dogecoin’s fund could reach $11 million in opening-day transactions. He also noted that a Chainlink ETF approval may be next, as exchanges and regulators show growing willingness to list altcoin products tied to blockchain infrastructure.

DOGE Price Reacts Before ETF Trading Starts

Dogecoin posts gains ahead of the ETF launch, outperforming Bitcoin and Ethereum over the same period as traders take early positions. Some analysts point out that institutional entries may combine with selling pressure from large holders, a pattern seen during previous launches. Volatility remains contained, which market participants interpret as a sign of disciplined inflows rather than speculative spikes.

XRP also attracts institutional attention. Earlier this month, Canary Capital reported that its XRP ETF reached $59 million in first-day volume and closed with $250 million in assets under management, reinforcing demand for regulated altcoin exposure. Brokerage desks note that continued institutional participation may encourage crypto liquidity providers to expand market-making activities across ETF products.

The debut of Grayscale’s XRP and Dogecoin ETFs pushes altcoins further into traditional finance. If trading volumes meet expectations, more issuers may accelerate applications, strengthening the presence of regulated crypto investment products in global markets.