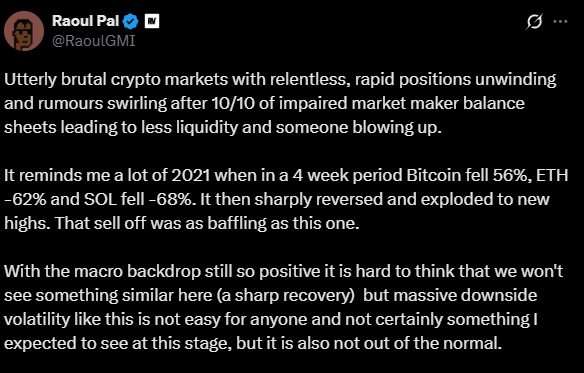

Raoul Pal analyzes the recent crypto market correction, noting that it is not driven by macro changes but by forced liquidations and deleveraging following the October 10 shock. According to Pal, the past six weeks have been “extremely brutal,” with liquidity loss and cascading selling pressure hitting altcoins especially hard.

The expert emphasizes that Bitcoin remains within its long-term bull cycle, where violent pullbacks are normal and necessary to support subsequent gains. Historically, major bull markets have seen declines exceeding 50% in short periods, such as in 2021 and 2019–2020, and altcoins typically fall more than BTC during these phases.

Pal points out that, although the market is deeply oversold, capitulation waves do not follow a fixed schedule, and rebounds can occur abruptly. His personal recommendation is to take advantage of extreme pullbacks to add positions, keeping in mind that volatility may exceed the tolerance of some investors.

The key message: the current drop looks dramatic, but it is part of Bitcoin’s historical pattern, where strong downside volatility coexists with the potential for extraordinary long-term gains

Source: https://x.com/RaoulGMI/status/1991863314142445702

Disclaimer: Crypto Economy Flash News are based on verified public and official sources. Their purpose is to provide fast, factual updates about relevant events in the crypto and blockchain ecosystem.

This information does not constitute financial advice or investment recommendation. Readers are encouraged to verify all details through official project channels before making any related decisions