TL;DR

- Michael Saylor speaks out again because a change in classification by MSCI could remove Strategy from major indices.

- A JPMorgan report warns that such a reclassification would force index funds to sell Strategy shares and increase short-term volatility.

- Saylor argues that Strategy is an operating company with a $500 million software business and digital credit issuances.

Michael Saylor spoke out again as market concerns grow over the potential removal of Strategy from major MSCI-managed stock indices.

A recent JPMorgan report warned that if the provider proceeds with a reclassification, index funds could be forced to unload the company’s shares, adding further pressure to a stock that has been declining since the beginning of November. The report and market reaction pushed Saylor to issue a public response for the second time in two weeks in an attempt to contain uncertainty.

Strategy Could Face a Very Delicate Situation

The debate is not only about how the stock is performing, but how MSCI interprets Strategy’s business model. JPMorgan suggested that the index provider could classify it as a passive vehicle tied to Bitcoin rather than an operating company. If that view prevails, institutional funds that track these indices would need to rebalance their positions automatically, a shift that could amplify short-term volatility. The warning quickly spread through the market and triggered another drop, with shares trading near $171 after an additional 3% decline.

Saylor Defends Strategy’s Business Model

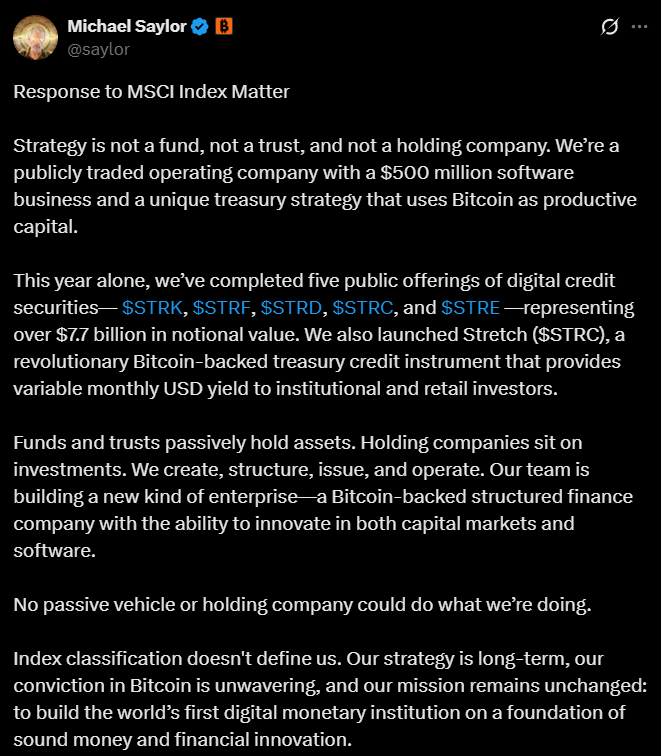

Saylor responded on X with a direct message. He clarified that Strategy is not a fund, not a trust and does not operate as a holding company that simply accumulates Bitcoin. He emphasized that the company maintains a software business of roughly $500 million, supporting its classification as an operating enterprise rather than a passive investment vehicle. He also noted that its treasury strategy uses Bitcoin as productive capital to back financial instrument issuances.

Saylor highlighted that funds and trusts are limited to holding assets, while Strategy designs, structures and issues digital credit products backed by its balance sheet. In 2025 the company completed five public offerings of digital notes — STRK, STRF, STRD, STRC and STRE — representing more than $7.7 billion in notional value. For Saylor, that activity defines a new corporate category that cannot be compared to passive instruments or replicated through traditional market structures.

Strategy is defending a space that combines a traditional commercial operation with a Bitcoin-based financing framework and needs the market to understand that difference.