TL;DR:

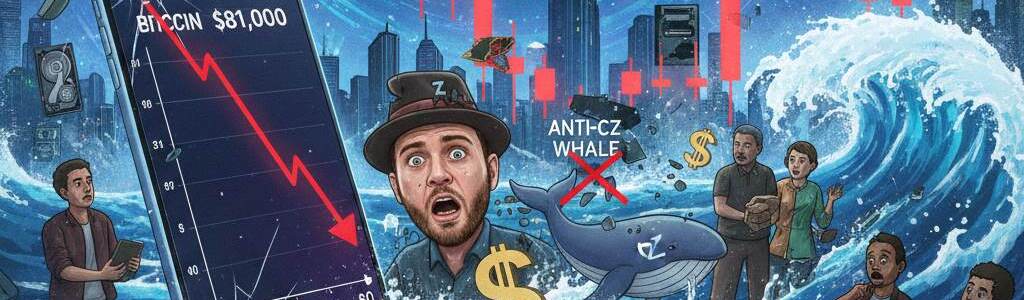

- Bitcoin crashes to $81K, causing mass liquidations including Andrew Tate and the “Anti-CZ” whale.

- Leverage amplifies losses, spreading panic across crypto markets.

- Analysts caution retail traders while noting potential buying opportunities for long-term investors.

Bitcoin plunged to $81,000, sending shockwaves through the crypto market and triggering large-scale liquidations, including high-profile figures such as Andrew Tate and the so-called “Anti-CZ” whale. The crash highlights the ongoing volatility in crypto markets and serves as a stark reminder of the risks associated with leveraged trading.

Andrew Tate(@Cobratate) opened another long on $BTC today — and got liquidated again in just an hour.

He has now been liquidated 84 times in total on Hyperliquid.https://t.co/JmOjQaP4fF pic.twitter.com/aZl53BhxE4

— Lookonchain (@lookonchain) November 21, 2025

Liquidation Wave Hits Major Players and Market Sentiment

Yesterday’s sharp downturn saw Bitcoin lose more than $10,000 in hours, erasing gains and catching over-leveraged traders off guard. Andrew Tate, known for his prominent Bitcoin holdings, reportedly suffered significant losses, alongside other influential market participants. Analysts note that the rapid drop amplified panic, leading to cascading liquidations across exchanges.

The “Anti-CZ” whale, a trader with notable public visibility opposing Binance CEO Changpeng Zhao, also faced heavy liquidations. Leverage positions amplified exposure, turning relatively small market moves into substantial financial consequences. These liquidations contributed to heightened market anxiety and further downward pressure on Bitcoin and other major cryptocurrencies.

Crypto derivatives markets reflected the turmoil, with perpetual futures showing significant increases in liquidations, particularly on platforms with high leverage offerings. Bitcoin’s decline also dragged other top assets lower, including Ethereum and Binance Coin, reinforcing a broad market sell-off.

Despite the chaos, some analysts argue that extreme volatility can create buying opportunities for institutional players and long-term investors. Historically, sharp corrections have occasionally served as entry points for well-capitalized participants seeking discounted exposure. However, retail traders remain cautioned against high-leverage positions amid unpredictable swings.

This event underscores the growing divide between high-profile crypto holders and smaller investors. Market psychology and social influence continue to play a role in driving volatility, as losses among notable figures often spark herd-like reactions. While the broader crypto market attempts to stabilize, caution remains key as Bitcoin consolidates near $82,000 and investors assess risk.

As regulatory scrutiny intensifies and liquidity fluctuates, analysts suggest monitoring support levels and trading volumes closely, noting that another sharp move could trigger further liquidations or set the stage for a rebound, depending on market sentiment.